Today, it is rather difficult to determine how many companies will go bankrupt, given the current circumstances in which we all find ourselves.

The pandemic is putting up a smoke screen, as many companies are receiving support from the various local governments and agencies. Once these support packages are dropped, bankruptcies will follow and grow to unknown proportions. Financial experts therefore have a rather negative view of the future and predict a new financial crisis. A painful reminder of how fragile the economy really can be.

If we take a look at pre-Corona times, on average between 40 and 50 companies in Belgium go bankrupt every day, leaving unpaid bills, unemployment and disrupted supplies. The reality is that when one company goes bankrupt, it can trigger a domino effect for companies they regularly trade with.

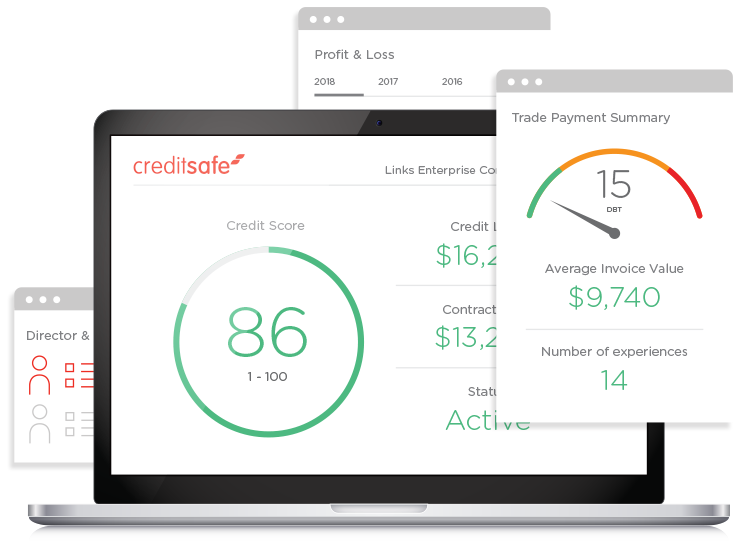

Therefore, companies today (especially now) need to tighten their credit management and customer acceptance to keep their working capital, cash flow and liquidity under control. We do notice that companies obtain some sort of business information (mostly with some online research), only that this is not yet properly applied, not properly gathered, not used properly or misinterpreted by most companies. For example, companies fail to consistently monitor their regular customers. Yet 3 out of 5 bankruptcies are among the regular client base.

From the 322 requests we receive on average per month to test our credit & risk management solutions, 20% of the companies still do not use (credit) business information and obtain information sporadically. 70% use (credit) business information from time to time, but without really understanding the risk indicators. Only 10% use financial business information efficiently on a daily basis, including the understanding of their credit risks.