We are proud to have the biggest, wholly owned database in the industry, providing accurate and reliable business data to over 200,000 subscribers across the globe. We gather data from numerous trusted partners and amalgamate it with our scoring algorithm, resulting in superior data powering our industry leading company credit reports.

A 360° view of your customers and suppliers

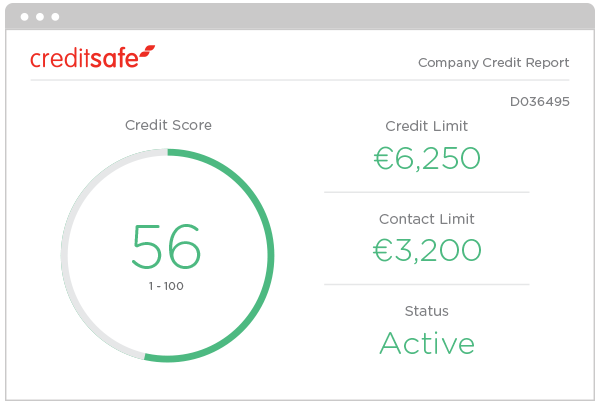

Credit Scores & Limits

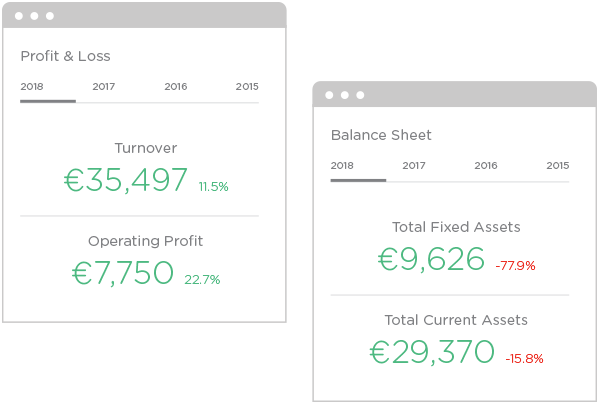

Financial Data

Director Information

CRO Documentation

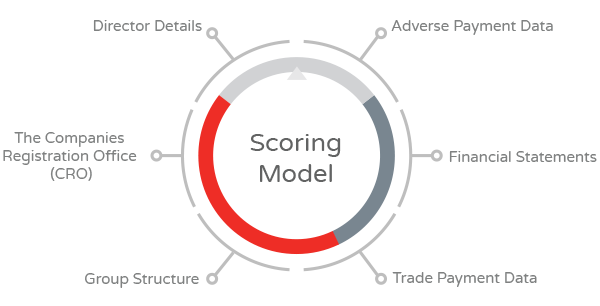

Data analysis is at the very core of what we do at Creditsafe. Our industry leading scoring system includes key statistical metrics and the most advanced statistical techniques to help determine the financial stability of a company.

With this scoring model, we can achieve a prediction rate of 70% of company insolvencies 12 months in advance, saving you the financial worry that bad debt can bring. In fact, our company credit scores and limits are so predictive that all leading credit insurers insure them.

Whilst we make every effort to simplify the credit lending decision for you through our scores and limits, we understand that our company credit reports are not only used for this reason.

If you are looking at a potential merger, takeover or tendering process, or simply want to see a more in depth view of the company you are about to do business with; we endeavour to fill our reports with the insight you need. It is for this reason that we include up to 5 years’ of full annual financials as standard.

In Creditsafe’s company credit reports you will always find (where available) the following:

- Profit & Loss

- Balance Sheets

- Capital & Reserves

- Key Ratios

- Cash Flow

In addition to this data, we also include access to scanned official CRO and Companies House documentation such as mortgages, new corporations, director changes, changes of registered addresses and much more.

In order to gain a better insight into a how a company operates, you need to know more about the people running the business, including their history.

Did you know that 43% of Irish directors were once the director of a company that is no longer trading? Or that 13% of UK directors hold more than 2 current directorships?

By reviewing the information on the people leading a company, you can get a better understanding of where the business is going. It is for this reason that our company credit reports include director information as standard.

Through our director reports you can expect to find the following information:

- Full Name and Address

- Month and Year of Birth

- Nationality

- Function & Role within the Business

- Appointment and Resignation Dates

- Current and Previous Directorships

We also include within our director reports the credit score of the company a director has resigned from at the point of resignation.

Get a better view…

The Creditsafe system gives you the ability to access all the original official documents that have been submitted to the CRO and Companies House (for UK companies) in one place.

-

Prevent Fraud

Cross reference directors’ signatures against official records

-

Competitor Analysis

Perform in depth customer analysis

-

Ease of Access

Save time by viewing all documents in one place

Our company credit report features

We are always striving to be at the forefront of the industry by adding new features to our reports, such as:

-

Up to 5 years of Annual Accounts

Review key financial statements such as turnover and profit & loss over the last 5 years.

-

Adverse Payment & CJ Information

Review a company’s adverse payment history in detail before conducting business with them.

-

CRO & Companies House Documents

Original CRO & Companies House documents available to download.

-

Global Structure

Review over 365 million company credit reports instantly online with the Creditsafe database.

-

Trading Locations

Identify any logistical concerns by exploring the full list of company addresses.

-

Group Structure

View ultimate and parent holding company information including those overseas and possible linkages.

Where does our company data come from?

We pride ourselves on the quality of data and business intelligence we supply.

The data used to create our credit scores and limits comes not only from working with official sources such as as The Companies Registration Office, The Registry Trust, Gazette Information and Companies House (UK data), but also our carefully selected network of international data partners from around the world.

To further increase the validity of our data we also include trade payment data from our trusted trade payment data suppliers giving you the most accurate picture of the financial stability of a company as possible.

Trade payment data explained

As companies file their accounts with official bodies annually, the payment behaviour of a company is a strong indicator of their current financial situation. For example if a medium sized businesses pays on average 50% of their bills late, they are statistically proven to be 4 times more likely to become insolvent.

It is for this reason that we created the Creditsafe Trade Payment Programme. To date we have over 7,000 suppliers of trade payment data worldwide and now over 63% of all our viewed credit reports contain trade payment data.

Monitor any business that can influence yours

Never miss a vital change to any company in your portfolio with customisable alerts sent to your inbox.

-

Change to Company Information

Receive email updates on any changes to companies you are doing business with. For example, if they change their registered address or a director resigns.

-

Monitor Debtors

Create portfolios of your debtors and receive instant alerts to any changes on that company. If a debtor picks up a CJ or their credit score changes we will be sure to send you an alert.

-

Export Updates

Export your entire portfolio with all of the up to date business information appended. You can select the information that you want to see from 17 different categories.

Concerned about a customer that could be a threat?

Quickly perform a company credit check on any Irish or UK business

Frequently asked questions

A Creditsafe business credit score calculates the probability of a company becoming insolvent within the next 12 months. We highlight creditworthiness through our ‘traffic light’ system of credit scoring – red advises you to be cautious and request a cash payment; amber suggests that you negotiate short payment terms; and green gives you a positive credit decision. Our credit scoring provides a score of 1-100.

The credit limits that feature within the Company Credit Reports are approved by all leading credit insurers. As an approved source it means that policy holders can use our recommended credit limits and integrate this into their discretionary policy limit or at a level advised by their credit insurance underwriter.

Creditsafe international database reports are updated in real-time, over 1 million times a day.

Your business credit score is calculated using the most sophisticated statistical algorithms available. It takes into account over 150 parameters as well as economic and industry factors.

No, unlike some of our competitors, we believe providing all the data you need in one report to make an informed decision.

Our data is collected from over 200 sources; where possible we will collect information from official registries such as The Companies Registration Office. Our network of 16 offices and trusted local partners allow us to collect information locally; ensuring we always deliver quality, fresh information.