Finance technology is developing quickly and is driving rapid change throughout the financial services sector and beyond. Creditsafe has collaborated with Fintechs globally including start-ups, technology companies and financial institutions to help innovation and disruption through access to our worldwide database and simplified onboarding solutions.

Trusted by over 1,700 Fintechs worldwide

Powering data to over 1,700 Fintech companies

-

Verify a client’s ID instantly

Our AML checks screen against global PEPs and Sanction databases to give you the highest protection against terrorism funding, fraud and other unlawful financial activity.

-

Screen against 300+ sources

Instantly cross-reference over 300 data sources to manage and mitigate risk including Credit Data, International PEPs and Sanctions Lists, Passport and European ID Cards, Electoral Roll, plus household and utility bills.

-

Ensure regulatory compliance

Our Anti-Money Laundering checks meet the standards outlined by the Joint Money Laundering Steering Group (JMLSG) guidance, ensuring peace of mind that your due diligence is fully AML compliant.

-

Seamless integration

Integrate any of our API solutions into your existing processes effortlessly with full real-time support from our dedicated industry experts.

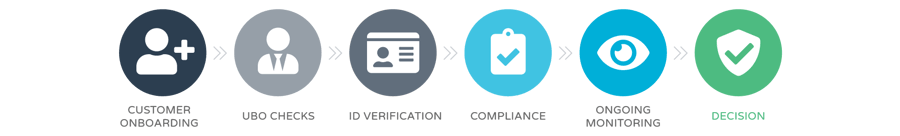

Automate your Know Your Business (KYB) & Know Your Customer (KYC) checks with Creditsafe

Company Credit Reports

Instantly access global business credit reports, with 99.9% of reports available within seconds online.

-

International Coverage

Access more than 365 million companies in over 160 countries.

-

Real-time Monitoring

Get instant alerts about changes to your customer and supplier credit reports.

-

Business Verification

Verify a company is genuine, confirm its registered details, address and legal status.

A single API for global business, compliance, and consumer intelligence

Access real-time Creditsafe data through a single API, all in one place.

-

Almost 400 million company records

Get all the key company information you need on any company, collected from official registries globally then enhanced with a trusted company credit score.

-

Key financial company data

Full financials let you understand if a company is growing and financially stable.

-

Consumer credit and identity verification

Full consumer credit data including credit score, limit, electoral and account data.

-

ID Verification

Quickly and easily complete a full anti-money laundering (AML) search on individuals.

Integrate with the apps you already use...

PEP & Sanction List Screening

Creditsafe’s PEPs and Sanctions checks enable your Fintech to exhibit strong governance all the while upholding a reputation of integrity.

-

Screen against a multitude of global and domestic PEP, Sanction and Watchlist databases in one go.

-

Increase efficiency, protect your business against the threat of non-compliance and mitigate the risk of large fines with Creditsafe’s online Compliance Search.

-

Creditsafe monitoring removes the need to manually schedule compliance monitoring updates, allowing your teams to focus on other priorities.

Creditsafe were always quick to respond, which made the process much easier for us. You work with businesses but you also work with people, and having a designated account manager was key for us.

Sanjay Padhee

CEO, ClearFactor