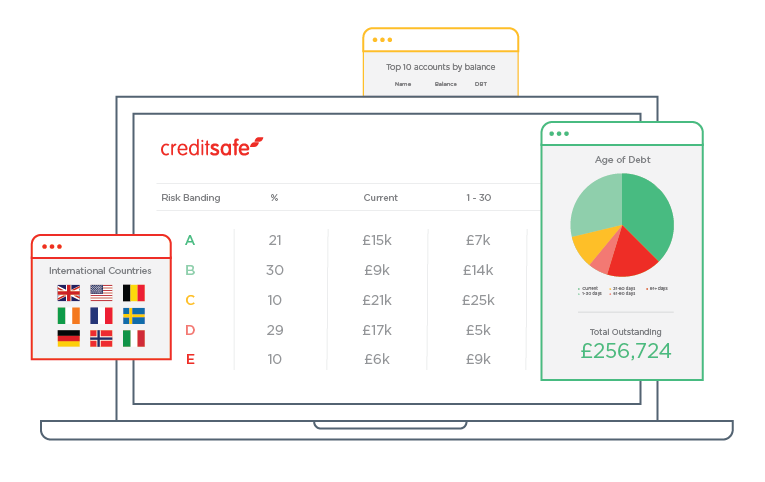

The 3D Ledger from Creditsafe makes it possible to keep track of your outstanding invoices in one single overview, based on the linked credit risk in relation to the outstanding days within and beyond terms.

This efficient credit management solution links the outstanding invoices to the credit score of Creditsafe and labels the risk category of the debtor, based on your outstanding days within or beyond terms. This allows you to act much more promptly in case of impending bad debts and depreciations due to imminent insolvencies.