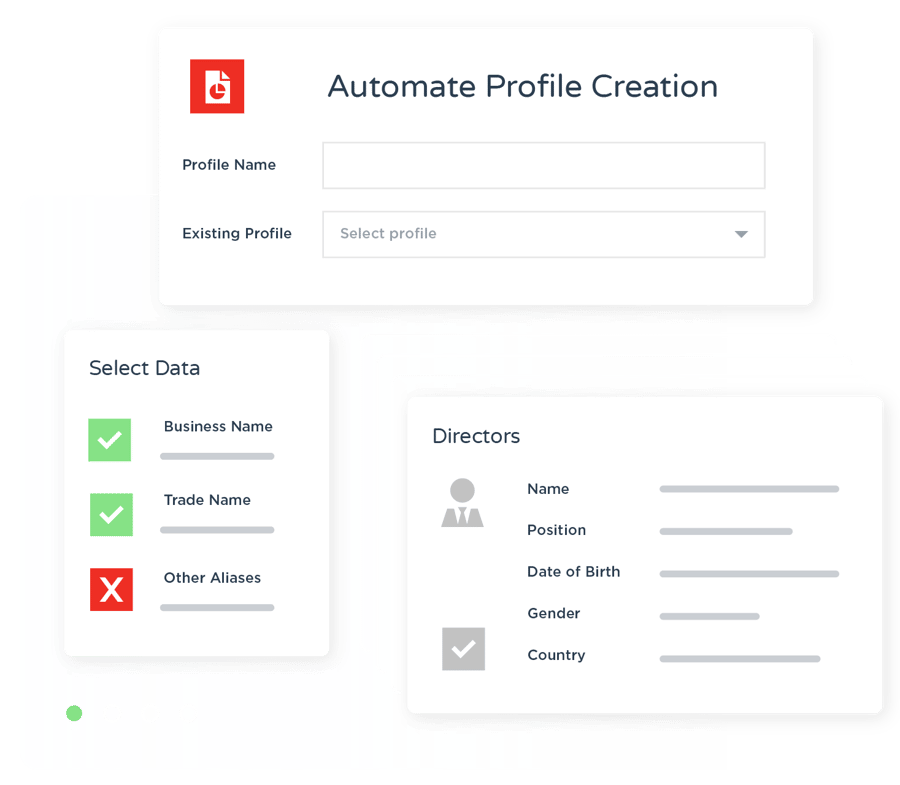

Quickly identify directors, shareholders and UBOs within a business and automatically create KYC profiles powered by Creditsafe's global database.

Leverage Creditsafe's dataverse to protect your business.

Protect your business from financial crimes, money laundering and reputational damage

Safely onboard customers and suppliers with speed and accuracy

Build long-term business relationships with people you can trust

Decrease your workload with a reduction in false positives by up to 80%

Leverage Creditsafe's dataverse to protect your business.

430 million company reports across over 200 countries and territories

1.4 million group structures and 5.4 million corporate linkages globally

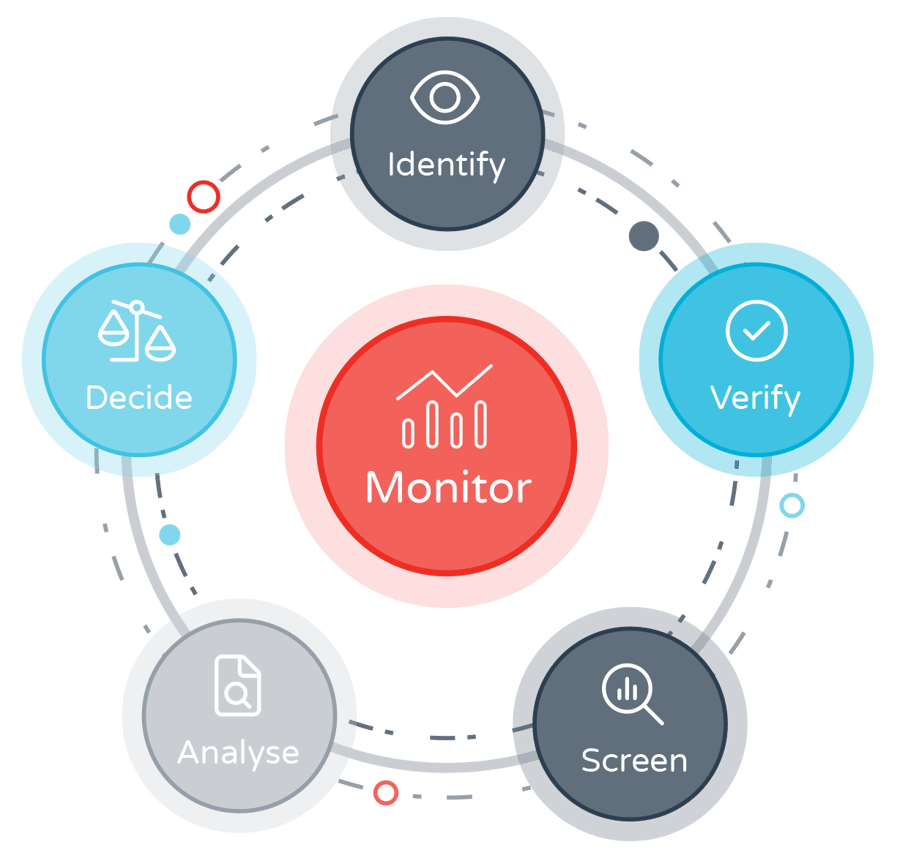

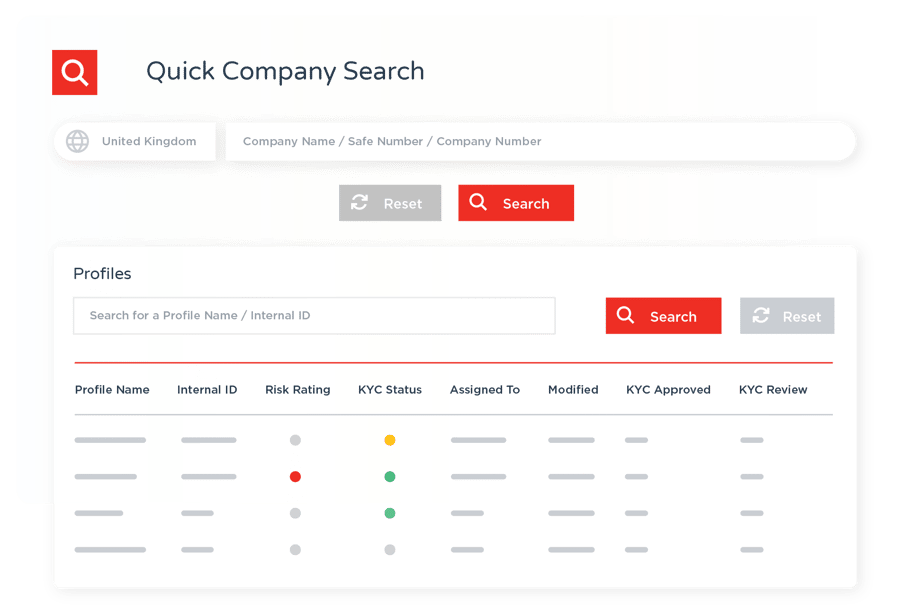

Screen against all major risk categories to protect your business from legal, financial and reputational threats. You can also filter by sanction type and PEP tier for even more precise risk assessment.

Sanctions

PEPs

State Owned Enterprise

Enforcement

Adverse Media

Profile of Interest

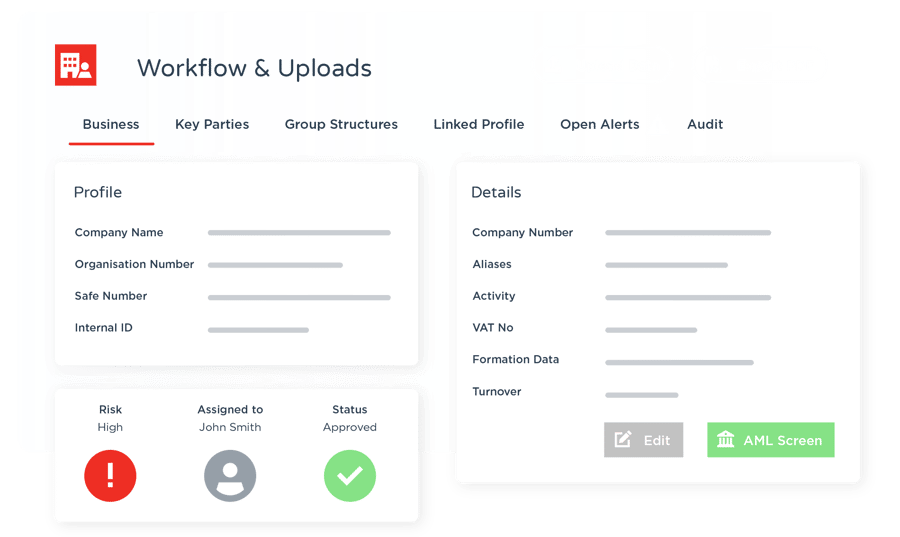

Track case status and collaborate with colleagues to ensure a smooth transition from search to decision in just a few clicks, made easier by intuitive profile statuses. Create clean and consistent risk management processes and reduce the likelihood of human errors.

Frictionless workflows to assign cases by status

Upload documents to consolidate relevant data

All actions captured in digital audit trail

AML Monitoring in 233 countries covering global sanctions (OFAC, OFS etc.), watchlists, PEPs profiles and adverse media.

KYC Monitoring in 46 countries covering changes to company registration details, status, directors, financials and negative information.

Website

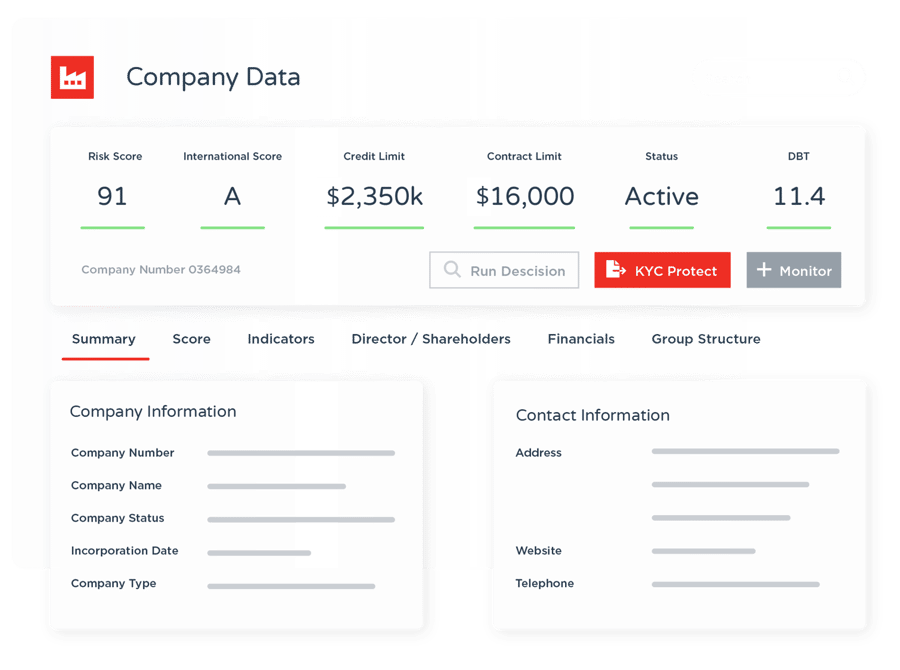

Access KYC Protect online via our intuitive and user-friendly Accelerator platform. The user interface is designed so you can seamlessly move from our company reports to KYC Protect.

Connect API

Integrate KYC Protect into your in-house systems to create continuity between due diligence and your existing business operations.

User Freedom and Flexibility

There are no restrictions on the number of users you have. Just sign up and reduce your risk with KYC Protect right away.