It is the second incident in the region in just a few years. In 2021, one of the largest container ships was stuck in the Suez Canal for six days, which thoroughly disrupted trade between Asia and Europe and vice versa.

During the COVID-19 pandemic, many manufacturers experienced significant supply chain disruptions. A well-known case is that of a global player in the electronics industry, whose production relied on components from several Asian countries. To mitigate future risks, the company talked to multiple suppliers and entered into new agreements. It also invested in technology for better forecasting and real-time supply chain tracking.

3. Uncertain economy

Economic volatility, such as changing consumer demand and unpredictable economic cycles, creates an unstable market. This requires companies to be flexible and adaptive, but also to carefully balance between expansion and investment or cost-cutting and downsizing. It does not make planning and budgeting easy.

A real-life example

A company in the building materials industry saw a sharp drop in demand during the 2008 economic recession. The company survived by diversifying its product lines, entering new markets and investing more in marketing during the downturn. It enabled the company to be better positioned when the market finally recovered.

4. Technological lag and innovation pressure

Rapid technological advances constantly force companies to question their production processes and innovate products. Companies that lag behind in this can lose their competitive edge, leading to reduced market share and potential failure.

A real-life example

Eastman Kodak, once a dominant player in the photography and film industry, did not immediately see a threat in the digital camera. It swallowed a significant drop in demand for their traditional products, especially when Apple launched its iPhone. Eastman Kodak was no longer able to change the giant organisation's course anymore and eventually even went bankrupt. Competitors that did innovate in time quickly took over the market share. Many tech companies, meanwhile, are investing heavily in R&D to maintain their place at the forefront.

5. Environmental legislation and sustainability obligations

Stricter environmental legislation can lead to higher operating costs for companies that do not comply with new standards. European laws and regulations around ESG present companies with huge challenges and additional investments in sustainability.

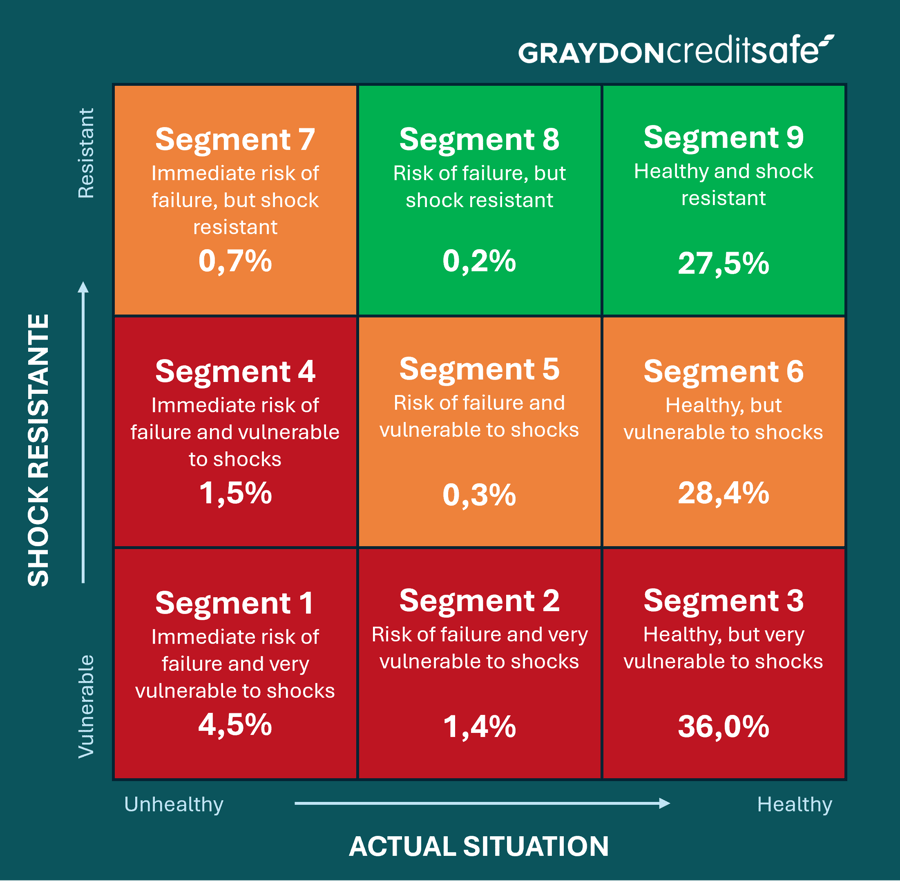

We refer again in the table below to the Resilience Indicator, which we have linked to the ESG Indicator. The ESG Indicator shows how a company scores on the themes of environment, social and governance. Analysis shows that 7.99% of companies in the manufacturing industry still have a long way to go in this area (segment at the bottom left of the table). They are not ESG-ready at all, nor do they have the investment capacity to finance the transition autonomously. These companies are likely to run into trouble and may even be doomed.