Lenin once said there are decades where nothing happens and weeks where decades happen. The current period appears to be of the latter type, especially for manufacturers around the world. As manufacturers slowly rebuilt their supply chains after COVID-19, the overnight Russian invasion of Ukraine scattered them into disarray. This created a whole new set of war-torn baggage: increased red tape, no-fly zones, and sanctions - causing a major knock-on effect on many UK, EU, and North American manufacturers.

In recent months, manufacturing businesses suddenly found themselves facing a deluge of new regulations. This increased the pressure on compliance teams and suppliers everywhere, with little refuge from risks anywhere near the war-torn areas – whether it’s the land, the sea, or the air. These were then followed by the fears of the Chinese invasion of Taiwan, the Houthi-incited concurrent attacks on ships in the Red Sea, and the ongoing Israel-Hamas conflict. This led to many businesses facing halted productions, longer shipping times, and, at worst, severe reputational damage from wrongful associations with sanctioned suppliers and entities, often leading to massive public boycotts and even shutdowns.

In this piece, we’re deep-diving into the different kinds of sanctions and what manufacturers can do to steer clear of risk as the list of sanctions continues to grow longer.

Penalties & lessons: How are sanctions impacting manufacturers?

Sanctions come in all shapes and forms – but amongst these, the sanctions on trade, import, exports, and associating with ‘specially designated persons’ are often complex and highly risky to reputation and commercial damage to manufacturers.

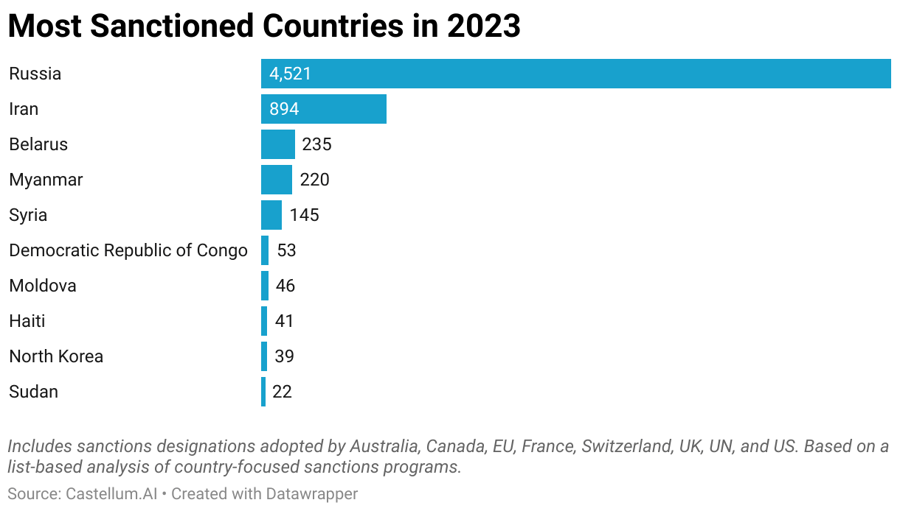

Over 1000 additional sanctions were introduced after the Russian invasion of Ukraine in 2023, and several new ones are being imposed regularly in lieu of the Israel-Hamas conflict this year. As war and terrorism-related sanctions snowball into longer lists each year, it is important to take a deeper look into what each ‘often-misinterpreted’ type of sanction means and some real-life examples of the risks they carry in our breakdown below:

‘Trade Sanctions’ like embargos & restrictions on imports and exports

As the name implies, these sanctions prohibit a company, industry, or organization from trading with a sanctioned regime. These could be imposed in the form of barriers such as the application of fees or taxes on the import of goods like the UK raising taxes on Vodka by 30%. Some other barriers include banning or limiting goods. One notable example is the US banning the import of all luxury goods, seafood, and diamonds from Russia or the EU slowly phasing out one of Russia’s biggest exports, Oil and Gas.

While these actions were designed to penalise the regime and financial control of Russia’s president Vladimir Putin, they have impacted many small businesses and even large businesses and their consumers – most of whom have nothing to do with the invasion but are still suffering the consequences.

Manufacturers, especially, have faced both great disruptions and risks. Due to the complex nature of material procurement and production, many global manufacturers have come under the scrutiny of authorities for failing to comply with these sanctions. For example, the EU Environmental Ministry recently investigated over 4,500 timber manufacturers in Belgium for breaching the Russian sanctions and importing over 260 tonnes of timber harvested in Russia, even though it was procured through Turkish and African suppliers.

Breaching these sanctions also comes with high penalties and severe reputational damage. Long before the Russia-Ukraine War unfolded, Elf Cosmetics came under fire and suffered substantial financial losses. The popular ‘cruelty-free’ cosmetics giant did not have adequate supplier transparency to track that their manufacturers in China were exporting a part of the ‘fake eyelashes’ from a second-tier North Korean manufacturer. With North Korea being a sanctioned entity, the authorities declared it as a breach, which led Elf to settle a penalty for a hefty sum of just under $1m, along with some reputational damage, despite them being ‘unknowingly complicit’ to the breach.

Sanctions on ‘Specially-Designated Persons’:

After the Russian invasion of Ukraine, at least over 1000 new individuals have been placed under the ‘specially-designated persons’ (SDNs) category within the Russian sanctions. These range from shell companies, partner entities, or Russian enterprises that are owned, controlled, and suspected to have close ties with Russia. In certain cases, governing bodies may also action the freezing of the assets they own as well as the ‘state-owned assets’ of the sanctioned regime or individuals.

US sanctions governing body, Office of Foreign Assets Control (OFAC), passed a new 50% rule that vets whether a sanctioned customer or owner owns 50% or more of a company. This rule went on to be particularly effective in exposing the ultimate beneficial owners or Russian shareholders who were hiding behind shell companies.

The extent of these sanctions was brought into mainstream media when Chelsea Football Club was plunged into crisis due to its owner at the time. The Russian oligarch Roman Abramovich, who owned most of the popular football club at the time, eventually had to put Chelsea FC up for sale amid the growing turbulence around his ‘sanctioned’ status.

How are manufacturers navigating the ever-growing list of sanctions?

The Russian sanctions, combined with the growing list of Israel-Hamas-related trade sanctions, are troubling news for manufacturers of all sizes—large ones with global, complex supply chains and diverse partners and SME manufacturers who are less equipped for the particularly time-consuming and resource-intensive due-diligence processes that are now required.

Nileema Ali, Creditsafe’s Product Manager, has spent over 16 years managing risk and compliance teams across major financial institutions like Deutsche Bank, JP Morgan, Lloyds Bank, Santander, and Wells Fargo. Through her experience, she was able to analyse some of the best practice methods from manufacturers around the world on how to manage the growing compliance burden with three basic tenets of compliance:

1. Consider your current/future sanctions list before entering business relationships

In practice, this also means reviewing your business plans, supplier plans, expansion plans and whether any current or future plans have proximity to any sanctioned countries

Before investing in resources and revamping due-diligence processes, auditing your current risk exposure or elements of the supply chain that could potentially fall under breach of a sanction is significant. It helps manufacturers determine their risk appetite and plan accordingly.

Being vigilant about complex and private ownership structures is significant in these times, when sanctioned entities or individuals may present their connections through layers of complex ownership models to extend business ties outside of the sanctioned regimes. Similarly, politically exposed persons (PEPs) should be thoroughly assessed for financial fraud, corruption, and possible financial scandals.

This includes deep diving into knowing your customers, suppliers (both tier one and tier two), as well as their corporate structures and beneficial owners. It may be time-intensive, but it is a crucial step in your risk mitigation.

2. Setting the right policies and programs

The second step to setting up your risk framework is developing a program that clearly outlines and informs your practices in the form of a ‘risk appetite’ statement. It should then inform your Anti-Money Laundering and Sanctions policies, in alignment with the products and services you provide and the markets you work in.

In practice, this also means reviewing your business plans, supplier plans, and expansion plans and whether any current or future plans have proximity to any sanctioned countries. Some resource-rich manufacturers will employ a designated compliance officer to develop and uphold these policies. For SMEs, the responsibility could be absorbed by someone in your management or leadership team, a credit manager, or a major gatekeeper within the business.

Once these policies are set, sharing them with employees with a clear approval and escalation process will set your policies and programs in motion.

3. Enabling your Compliance Officer with the right due-diligence tools & data

A risk-based approach should always be backed by data and insights, and most times, that means manufacturers need to analyse expansive geopolitical chessboards or monitor the imposing and revoking of sanctions—a resource-intensive and time-consuming process for many.

When it comes to compliance, both SMEs and large manufacturing firms often find themselves in the same boat. Since the value chain of SME manufacturers is typically less complex and less geographically dispersed, the risk faced is generally lower. However, they could still remain exposed to sanction breaches due to the lack of transparency in financial transactions and supply chain connections that may have hidden, complex ties to Russian routes.

On the other hand, large manufacturers with complex and global supply lines face a higher threat, requiring continual monitoring and evaluation.

Technology has developed rapidly in recent years to support manufacturers, provide real-time global visibility of their suppliers, and enable them to automate the risk management process.

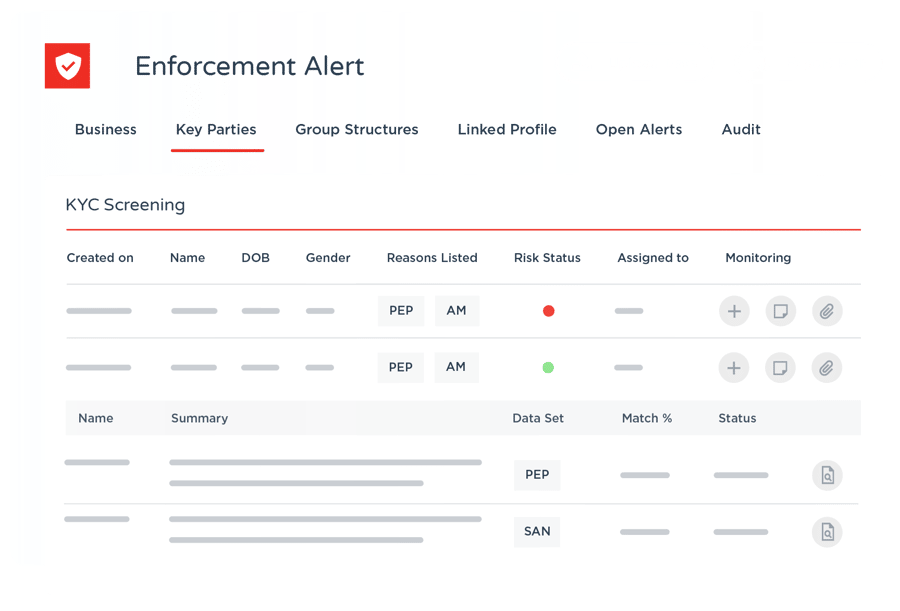

Creditsafe’s end-to-end due diligence platform, KYC Protect, streamlines two of the toughest areas of complex due diligence processes when investigating customers and suppliers: performing thorough investigations and gaining deep visibility into their background and ownership structures.

Done well, manufacturers equipped with a well-planned compliance framework and a dependable platform will likely thrive in the face of a volatile global landscape, which is expected to last for at least a few years.

Due-diligence platforms like KYC Protect ensure that manufacturers can focus on what they do best and minimise regulatory or reputational risk by only working with trustworthy customers and suppliers.

In these war-torn times, SME Manufacturers that have fewer resources and less time may struggle to keep up with the myriad of new sanctions and risk categories laid out by different governing bodies. Similarly, large manufacturers may have sophisticated compliance teams, but due to their complex global supply chains, they may also find it hard to manually track down the beneficial owners of all their suppliers.

Before onboarding new customers or suppliers, manufacturers can use KYC Protect to screen customers against a plethora of risk categories, including sanctions, enforcements, politically exposed people (PEPs), adverse media, state-owned enterprises, profiles of interest and insolvency registrations.

It's end-to-end, which means the platform also lets manufacturers go all the way from quickly searching for an individual or entity and verifying their identity, to viewing automatically generated, comprehensive risk profiles on them. Once a profile is created, they can then use the platform to monitor ongoing changes to their risk status, reducing the need for manual management.

It’s important to remember that due diligence platforms like these are developed to complement an existing compliance management framework. This framework should map the policies and controls manufacturers already have in place against relevant regulations alongside the due diligence platform—one cannot exist without the other.

Done well, manufacturers equipped with a well-planned compliance framework and a dependable platform will likely thrive in the face of a volatile global landscape, which is expected to last for at least a few years.