-

Your business is exposed to the risk of bad debt and late payments.

If your SAP S/4HANA system has limited and out-of-date credit and payment information for companies you work with, it will restrict your ability to assess risk and make the correct decisions for your business.

-

You're wasting time running manual checks on customers and suppliers.

The downstream impact of manual or dis-jointed risk assessment processes results in slower decision-making at critical moments like customer onboarding and supplier selection.

-

You lack confidence in the quality and accuracy of your data.

When your teams are manually inputting customer data or trying to research missing information it becomes a severe drain on their time and productivity while the likelihood of errors increases.

Integrating with GraydonCreditsafe helps you maximise the ROI of SAP S/4HANA

Access real-time data for over 430 million companies in over 200 countries and territories.

Dramatically reduce the time spent on manual data inputs from multiple sources.

Work with creditworthy businesses with a track-record of paying on time.

Better data means better decisions

A single trusted data source for company information and risk intelligence allows you to identify duplicate records and inactive companies. You only work with up-to-date information refreshed in real time to make informed and accurate decisions.

Using GraydonCreditsafe's connector to integrate powerful business data with your SAP S/4 HANA ERP enhances how you assess risk - so you work with customers and suppliers who are right for your business.

Our data gives you confidence that your business decisions minimise the risk of bad debt and late payments. You can leverage our data to negotiate favourable terms to protect and optimise cash flow.

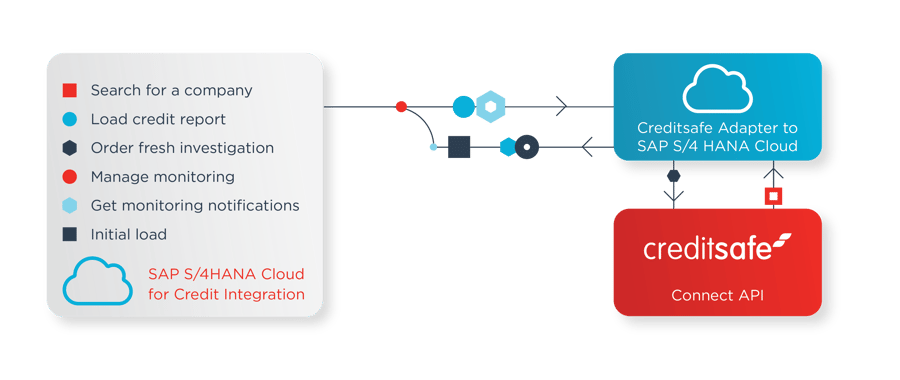

Fast, pain-free integration

Our connector makes the integration process frictionless so you can take advantage of GraydonCreditsafe data within 1-2 business days.

Connect SAP S/4 HANA with GraydonCreditsafe’s verified company profiles.

- World-leading credit, risk, and payment data from local and official sources.

- 99.9% of requested reports are delivered instantly.

- The most predictive risk scores and recommended credit limits in the industry.

- Fresh Investigations delivered in 5.5 days.

- No modifications in SAP standard code or standard tables.

- Multiple languages and translations.

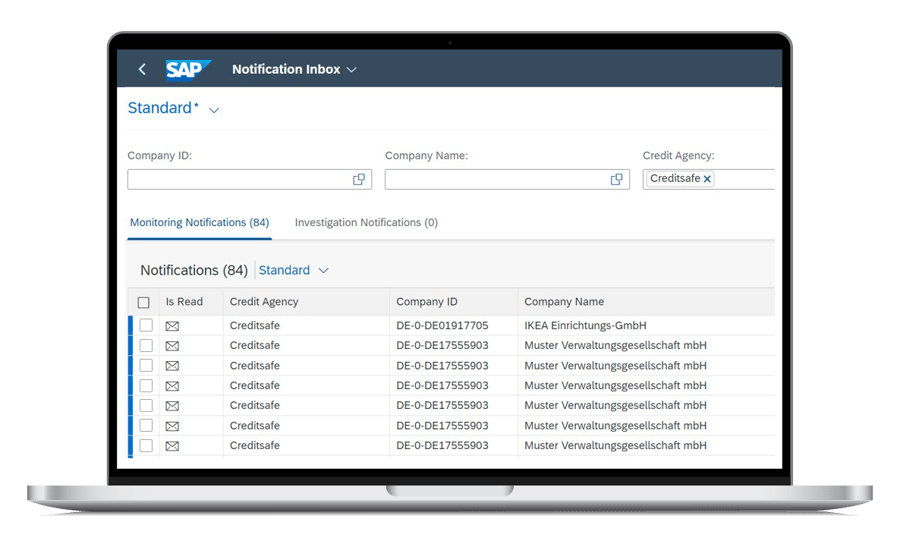

Never miss a beat

Integrating SAP S/4HANA with GraydonCreditsafe means you get real-time monitoring alerts in 46 countries. You will receive a notification anytime there is a noteworthy change of circumstance to the company you do business with. This could be a change to:

- Company Registration Details

- Company Status

- Credit Score

- Credit Limit

- Payment Behaviour

- Director Details

- Company Financials

- Negative Information

Global business intelligence for SAP S/4HANA

-

International Reports Coverage

A-E risk bandings available for businesses across 200 countries.

-

Globally Standardised Data

Understand the size, liquidity and maturity of any business.

-

Global Trade Experience Data

Explore historic payment data for businesses across the world.

-

Key Ownership Data

Establish who the directors, shareholders and UBOs are in a company.

-

Group Structure & Linkages

Internationally consistent and accurate group structure information.