Validating the integrity of your suppliers and protecting your business from partnering with businesses involved in corruption, fraud or other criminal activity is critical to complying with regulations, maintaining transparency and avoiding reputational damage. Creditsafe’s KYC, Screening and Monitoring solution enables end-to-end due diligence and helps to reduce the risk of operational disruptions and financial losses.

-

Select the Best Suppliers

Successfully manage your network of suppliers so that your production process runs smoothly and is consistently capable of serving your customers.

-

Improve Supply Chain Agility

Gain real-time supplier insights across your value chain that allow you to act when it matters most and ensure production continuity.

-

Protect Your Reputation

Ensure regulatory adherence to protect the credibility and integrity of your brand in the eyes of your customers and stakeholders.

Join the world leading manufacturers taking advantage of Creditsafe's global business data

Supply Chain Management

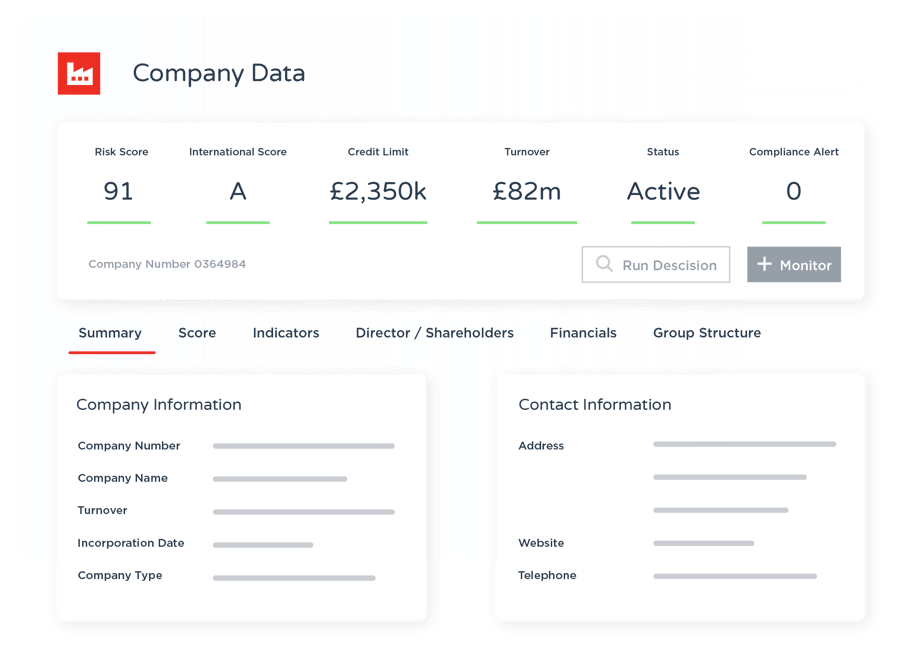

Determine the reliability of your suppliers, no matter where they are in the world

-

International Reports Coverage

Our business reports with A-E risk bandings are available worldwide for easy comparison internationally.

-

Globally Standardised Data

We simplify the diversity of international data, so you can understand the size, liquidity and maturity of any business.

-

Company Change Monitoring

Keep up-to-date with important changes across your supplier network and customer portfolio with daily monitoring alerts.

-

Director Profiles

Understand the leadership of the businesses that make up your supply chain, ensuring they have a competent track record.

-

KYB & Sanction Screening

Safeguard your reputation across your value chain by screening suppliers for ethical and regulatory adherence.

-

ID Verification

Verify domestic and international business associates are who they say they are with comprehensive ID verification checks.

Build a resilient supply chain

Your suppliers' financial stability can directly impact your production capabilities and ability to meet customer expectations. Continuity planning and risk diversification make you less susceptible to the supply chain disruptions associated with political instability, trade disputes and economic downturns.

Creditsafe’s business profiles help you to build a strong network of trusted suppliers and determine their suitability in terms of financial stability, company size and maturity, ownership and leadership.

-

Years in business

-

Business Size

-

Ownership & Leadership

-

Financial Statements

Enhance visibility of your supply chain to minimise disruptions

When suppliers face challenges that might diminish their ability to meet your timelines, it is imperative to identify potential risks before they disrupt your supply chain. Creditsafe's global company monitoring in 49 countries notifies you by email if a change of circumstance occurs for one of your suppliers that might negatively impact your business.

Use our real-time international monitoring service to stay on top of risk and act fast when changes occur to:

- Company credit scores and credit limits

- Company status & bankruptcies

- Accounts filed

- Director appointments

- Legal judgments

In-depth supply chain due diligence

-

Sanctions Checklist

Screen suppliers against global sanctions lists to safeguard your business from trading with prohibited businesses or regions.

-

Adverse Media Screening

Check and monitor both businesses and directors which have been linked to illicit activities from thousands of media sources worldwide.

-

PEPs Screening

Screen against the global Politically Exposed Persons (PEPs) database to identify individuals prone to bribery and corruption.

Make important supplier decisions when you need to move fast

Running credit and compliance checks when making a decision on the suitability and reliability of a suppliers are critical to maintaining the integrity of your supply chain. Creditsafe enables you to automate these checks so you can decide whether to partner with a customer in seconds and up to 70% faster than running checks manually.

Automation means you gain back the time your business needs to focus on decisions that require more attention and analysis so that you are selecting the most capable suppliers.

- No-code decision automation powered by our trusted global credit, risk and payment data.

- Decision tree templates can be set up in minutes integrating the rules and logic of your in-house policies.

- Bespoke options are available for more complex decision-making processes.

Creditsafe's global data coverage was a huge pull for us, it has opened new business avenues and ensures that we can investigate customers diligently should they have ties overseas.

Wendy Janes

Credit Manager, Scania

Our company data, exactly where you need it

We seamlessly integrate with your CRM, ERP or accounting package

Access our entire Creditsafe universe of 430 million reports across 200 + countries & territories without leaving your chosen software. Enrich your records with accurate data, monitor businesses, access full reports, and automate decisions. Choose one of our native apps for plug-and-play capabilities or connect with our API for bespoke integrations.

- Salesforce

- NetSuite

- Microsoft Dynamics

- SAP Business One

- Sage

Run a background check on an international company for free today

Join the 120,000 companies that use Creditsafe to grow and protect their business.

Frequently Asked Questions

Our international business reports include most of the information you would expect to find in a local report, however not all countries have the same amount of data (publicly) available. We sometimes need to gather information from other local sources so the information may vary country by country.

99.9% of all reports requested by our customers are typically delivered instantly online. Where a company is not available, a fresh investigation will take between 2-10 working days depending on the country.

When a company report is not available to view online you have the opportunity to freshly investigate a business. Once this request is received, we will attempt to contact the company directly using our network of local partners and official registries to provide a detailed report within as little as 2–10 working days.

Our data is collected from thousands of sources; where possible we will collect information from official registries similar to Belgian sources. Our network of 25 offices and trusted local partners allow us to collect information locally; ensuring we always deliver high-quality and up-to-date information.

As not all countries use a 1-100 score; using an A-E score makes it easier for you to compare the credit risk of companies from across different countries. A is the lowest risk, D the highest risk and E is unrated.

As a primary source of business information, the Creditsafe data universe is updated daily.