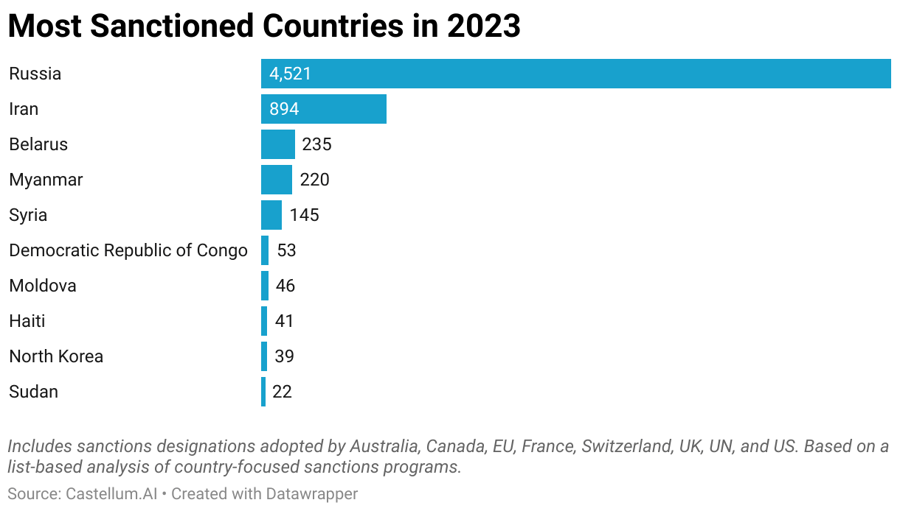

Lenin once said there are decades where nothing happens and weeks where decades happen. The current period seems to be one of the latter, especially for global manufacturers. As they were rebuilding supply chains post-COVID-19, the Russian invasion of Ukraine threw them into disarray. Governments swiftly imposed packages of new sanctions, causing chaos for UK-based manufacturers. The result of increased sanctions, no-fly zones and heightened red tape led many organisations to suspend their Russian operations – cutting off a vital revenue channel. A strategic decision that contributed to a £612 million impairment charge in British American Tobacco results.

In the wake of the invasion of Ukraine, manufacturing businesses suddenly found themselves facing a deluge of new regulations. Quickly followed by the Houthi-itched attacks on ships in the Red Sea and the fears of the Chinese invasion of Taiwan, compliance teams and suppliers found themselves with little refuge from risks anywhere near the war-torn areas – whether on land, sea or air. This led to many businesses facing halted productions, longer shipping times and severe reputational damage due to being associated with sanctioned suppliers and entities, often leading to massive public boycotts and even shutdowns.