What is invoice fraud?

Invoice fraud involves a fraudster sending fake invoices claiming to be from a genuine supplier, usually notifying your company that their payment information has changed and providing alternative details to defraud you.

Invoice fraudsters are sometimes aware of existing supplier relationships and will usually know the details of when regular payments are due. Often invoice fraud is only discovered when the legitimate supplier follows up on non-payment of invoices.

Fraudulent invoices are usually well-crafted and can be difficult to spot. Fraudsters send invoices from an email address that appears to come from your genuine supplier.

Once you send a payment it is often difficult to recover those funds, therefore, it's extremely important for your businesses and finance team to be extremely observant when making payments to suppliers, especially when payment details are changed.

How to prevent invoice fraud

Steps you can take to protect against invoice fraud:

How to verify business bank account details

Verifying that a bank account belongs to the intended recipient can reduce fraud and prevent costly administration errors.

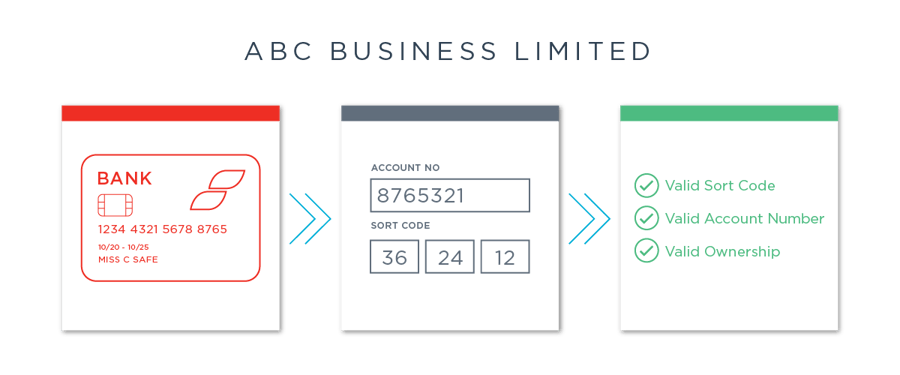

You can easily check that bank account details belong to the right business using Creditsafe. Our bank verification tool lets you enter business bank account information and instantly confirm if they belong to the company you expect them to.

What to do if you suspect invoice fraud

If you have paid the invoice, contact your bank immediately. The quicker you alert your bank, the greater the chance of recovering the funds.

You should also report it to ActionFraud – the police’s national fraud and cyber-crime reporting centre. Even if you’ve not suffered any financial loss, this will allow the police to analyse trends and help them to prevent fraudsters exploiting other companies. You can file a report via their website at www.actionfraud.police.uk

Start verifying business bank account details

Quickly check the bank account details you hold belong to the right business using our bank verification tool. Enter a business bank account number and receive instant confirmation it belongs to the correct company.