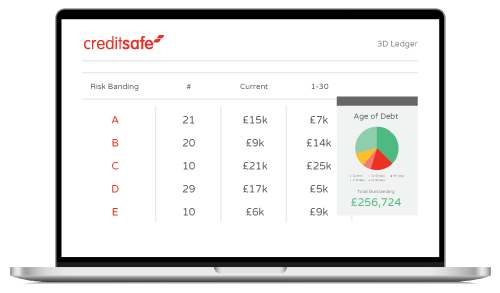

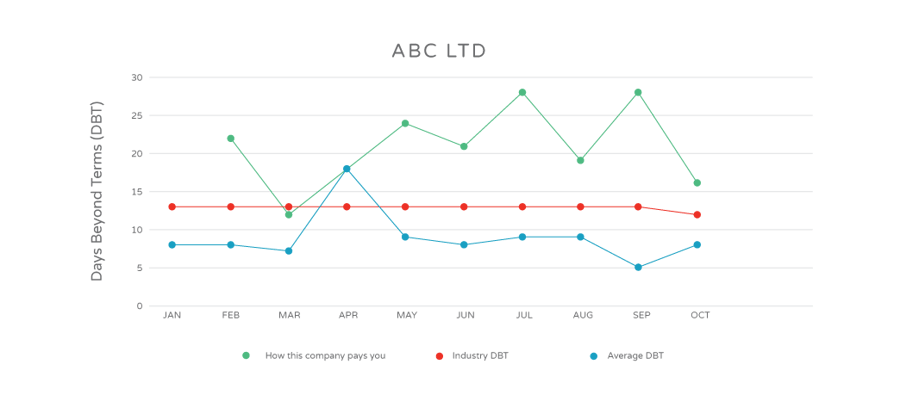

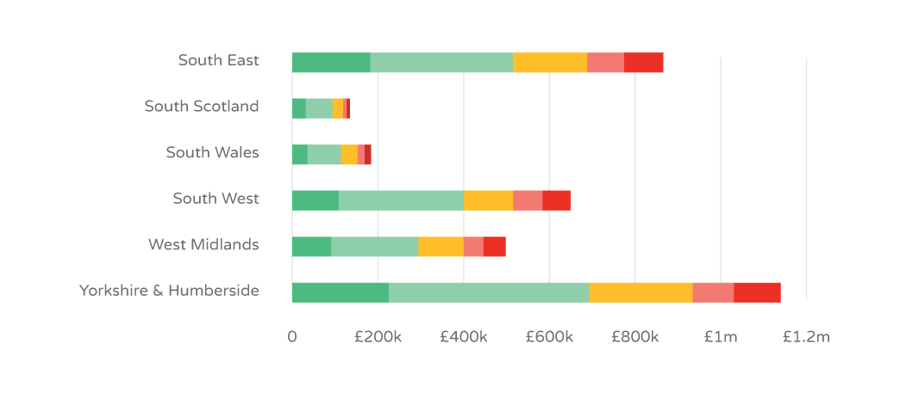

3D Ledger takes your own sales ledger data and combines it with our live international business data and over 300 million trade payment experiences. This combined data puts the ultimate solution in accounts receivables collection right in your hands.

You’ll have the tools needed to prioritise your payment collections and help lower the risk of bad debt, reduce invoice payment times, and improve your business’s overall cashflow.