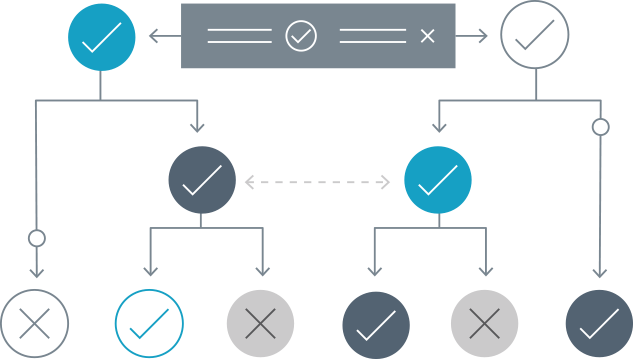

Make better informed credit-based decisions, in a fraction of the time, with Decision Engine. By integrating with our market-leading data and decision-making solutions, we can transform the way you do business forever.

Powered by our next-generation Connect API, Decision Engine can help you save time and maximise profit across your organisation by automating time consuming processes which drain your company’s resources. This frees you and your staff to spend more time working on achieving your business goals.