Solarlux, a leading glass system manufacturer, enhanced its customer onboarding with global business data. By utilising Creditsafe’s business intelligence, Solarlux can quickly verify credit scores and company details, ensuring reliable partnerships and faster project starts. Discover how Credit process and support their commitment to quality in the full customer story.

Working together with world leading manufacturing companies

Credit Risk Management

We empower global manufacturers to reduce DSO and boost working capital.

When customers pay later and seek extended credit terms, this can impact your production cycles and cash flow. Working with financially sound customers is central to securing on-time payment and reducing days sales outstanding (DSO).

The data and insights in Creditsafe’s online business reports across 200 countries enable you to select the right domestic and international customers while also negotiating favourable credit terms that protect your business.

Our business reports help you understand the financial health of your customers with hundreds of key insights, including:

-

Director details

-

Company ID data

-

Shareholder & UBO data

-

Company risk profile

-

Standardised

-

Corporate hierarchy

We needed a tool that would provide us with all the correct details for any UK company to give us complete confidence in knowing who we are dealing with before starting a new project.

Robert Walton

Project Sales Manager

Discover new growth opportunities

Manufacturing companies often attribute a high percentage of their revenue to a few key customers. The risk of doing this heightens when demand across the industry has slowed for a multitude of reasons. Creditsafe’s global data enables you to identify attractive opportunities within and beyond your existing customer base to help mitigate the risk of non-payment from a single source.

Diversify your portfolio without attracting additional risk using our company insights:

- Pre-qualify leads based on affordability.

- Identify under-utilised credit limits.

- Discover sister and parent companies.

- Enrich your records with firmographic data.

Why choose Creditsafe?

-

Secure Revenue On Time

Having a 360-degree view of your customers means you can identify risk early, respond in real time and actively reduce DSO.

-

Select the Right Customers

Make the right decisions for your bottom line when you accurately assess the credit risk of your prospects and new customers.

-

Protect Your Reputation

Ensure you are working with legitimate customers to protect the credibility and integrity of your brand in the eyes of your stakeholders.

Faster path to revenue

Transform customer onboarding into a competitive advantage by standardising and automating manual credit checks.

Creditsafe speeds up credit checks by 70%, swiftly identifying risks and eliminating bottlenecks in the process. This efficient approach allows your credit team to assess new customers more efficiently and faster, reducing operational risk.

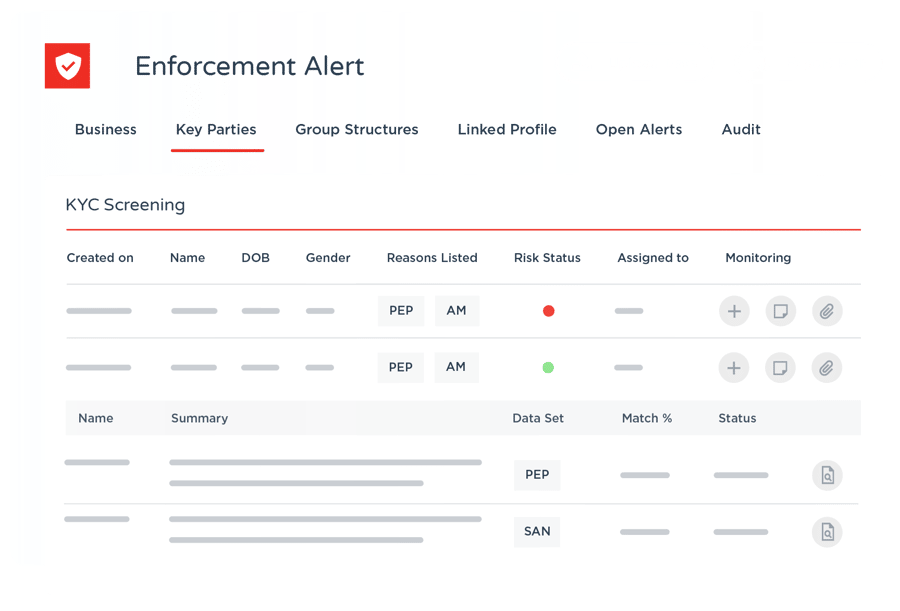

Do business with law-abiding and ethical customers

An expansive network of domestic and global customers exposes manufacturers to the increased risk of working with a sanctioned entity or a business involved in criminal activity. Creditsafe's comprehensive due diligence platform with KYB and adverse media screening services allows you to manage risk effectively and onboard new customers with speed and confidence.

-

A Single Solution for KYB Screening

Creditsafe’s global business data helps you verify the identity of a customer and provides director and shareholder information that can be screened and monitored in a single click.

-

Screen Against Multiple Risk Categories

Sanctions, Enforcement, PEP, Adverse Media, State Owned Enterprise, Profile of Interest, Disqualified Director, Insolvency Register

Integrate with our international database via the Connect API

Build Creditsafe data into your existing systems for rich insights exactly where you need them

Integrate with the Connect API for instant access to our entire Creditsafe universe.

With a single API, you can gain insight on over 430 million companies worldwide with data from more than 8,000 sources. Our global company data provides you with up-to-date coverage, enriching your data with real-time information.

The Connect API provides access to international monitoring as well as the option to drive automation, helping you incorporate real-time customer intelligence and efficiency into every decision you make.

Run a background check on an international company for free today

Join the 120,000 companies that use Creditsafe to grow and protect their business.

Frequently Asked Questions

Our international business reports include most of the information you would expect to find in a local report, however not all countries have an equivalent to Companies House in the UK. We sometimes need to gather information from other local sources so the information may vary country by country.

99.9% of all reports requested by our customers are typically delivered instantly online. Where a company is not available, a fresh investigation will take between 2-10 working days depending on the country.

When a company report is not available to view online you have the opportunity to freshly investigate a business. Once this request is received, we will attempt to contact the company directly using our network of local partners and official registries to provide a detailed report within as little as 2–10 working days.

Our data is collected from thousands of sources; where possible we will collect information from official registries similar to Companies House. Our network of 25 offices and trusted local partners allow us to collect information locally; ensuring we always deliver high-quality and up-to-date information.

As not all countries use a 1-100 score; using an A-E score makes it easier for you to compare the credit risk of companies from across different countries. A is the lowest risk, D the highest risk and E is unrated.

As a primary source of business information, the Creditsafe data universe is updated daily.