1. What does a company credit score do?

A credit score provides your risk and credit management with a clear insight into the financial stability or the solvability of your business relations.

Commercial credit decisions can only be taken thanks to the collection of the correct (credit) risk company data about your new and existing customers. This collection of financial business information is transformed into a clear presentation or overview, enabling you to make a clear and informed credit decision. This indication thus directly supports you in optimising your credit risks and keeping your own cash flow 'healthy'.

The company credit scorecard behind the credit score calculates the probability of a company's failure and is usually included in a company credit report. At Creditsafe we make this prediction over the next 12 months.

The purpose of a credit score is to give your credit and risk departments the necessary insights into the credit risks of your business relations. Therefore, it is literally translated into the probability of default (PD or PoD). We will discuss this in more detail below.

Bad debts, outstanding balances, overdue invoices and write-offs go hand in hand withimpending failures.

Without liquid assets or cash, a company cannot remain operational, production is jeopardised, there is a cash shortage and there is a very real chance that they will no longer be able to pay their suppliers (on time).

2. How does a company credit scorecard work?

A credit scorecard is produced by external, independent parties such as organisations active in business credit assessments, business information and business credit information. First of all, these organisations collect the necessary (financial) company data.

Creditsafe collects this data from more than thousands of sources such as national official registers or agencies, local publications, collection sources, etc.

The financial company data we collect comes from official institutions such as the National Bank, Crossroads Bank of Enterprises (CBE), Official Gazette, etc. Creditsafe also makes use of a strictly selected network of international data partners all over the world. In order to further optimise the validity of our financial business information, our database also includes payment data behavior through our trusted payment transaction providers.

The collected data is first extracted and then transformed or processed to ensure that all data elements are properly distributed for the right purpose. Once these stages are completed, the data can be incorporated into a credit algorithm, where statistical regression models can be used to distinguishing low, medium and high credit risk companies.

3. How is the credit score calculated in a scorecard?

From small (local) companies to large SME's and multinationals, the factors that influence the eventual bankruptcy of a company differ per company size and industry. To increase the predictability and stability of a credit score (card), Creditsafe segments all companies within a population based on available information, size and type of company.

No two companies are identical, but most show similar signs of failure within a population. To increase the distinctiveness of a Creditsafe scorecard, the populations are segmented. The goal of segmentation in Creditsafe is to define a set of subpopulations that, when modelled individually and combined, will rank credit risk better than a single model on a total population.

Within each credit scorecard, the importance that each factor has on the credit score varies according to its statistical relevance in relation to a business failure. Below we show some of the key elements that can be used to calculate a credit score.

- Official publications

- Address changes

- Director changes

- Business sectors

- Filed annual accounts

- Linked companies

- Company size

- Business types

The accuracy and predictability of a credit scorecard is vital to fully assess opportunities and credit risks. Failing to recognise a company that is in danger of going bankrupt is, of course, an immediate credit risk. On the other hand, wrongly rejecting a potential customer means a loss of business and represents a financial cost.

The essential concept behind the Creditsafe scoring approach is to accurately predict the behavior of companies (in terms of their good/bad performance over the next 12 months) using a set of characteristics that clearly indicate why a company can be considered a high or a low credit risk. This distinction between "good" and "bad" companies, i.e. those with a high or low risk of failure, is the essential feature of a good credit scoring model.

4. What is the Probability of Default?

The Probability of Default (PD or PoD) is a mathematical calculation that shows how likely it is that a company will fail within 12 months of the date of application for a particular credit.

The PoD is a simple representative way for companies to accept, modify or even reject credit applications. This probability can be applied to a wide range of scenarios for risk management and credit analysis. The PoD depends not only on the characteristics of the debtor, but also on its economic environment.

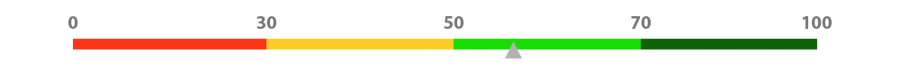

The Creditsafe scorecard provides a score between 1 and 100 for the highest and the respectively lowest risk. This scale is produced based on the outcome of the PoD, expressed as a percentage. The higher the Creditsafe credit score, the lower the PoD percentage and vice versa.

A practical example to put the above into perspective:

Company A has a low credit score of 10 out of 100 in the Creditsafe credit report. As explained, a low credit score implies an increased credit risk and a higher probability of default or failure. Therefore, the PoD matched to the credit score assessment reflects as such an increased percentage.

What is demonstrated here?

With a score of 10 out of 100, the credit score predicts that the company in question has a real chance of failure within 12 months of the date of application for a particular credit. Therefore, this company has an increased probability of posing a credit risk to your (standarised) credit policy.

Based on this information, your finance or credit management department has the insight to accept, modify (such as payment in advance or payment plan) or to decline the 'credit'.

5. Why is a credit score assessment important?

If you have read through the above 4 points, we can only conclude that a credit risk assessment of a company is crucial for the finance and risk departments within your organisation.

The credit score allows you to make an immediate distinction between risky and financially healthy companies. By designing and implementing a consistent credit control policy (by aid of a credit check), you will be able to manage your credit risks, get clear insight into the financial stability of your business relations and you have the means to optimise your liquidity and cash flow; allowing you to continue to do business with potential and sustainable growth.