High Radius Artificial Intelligence

Streamline credit management for smart, agile and efficient operations

Onboard Customers Faster

Automate Credit Scoring

Streamline Credit Approval

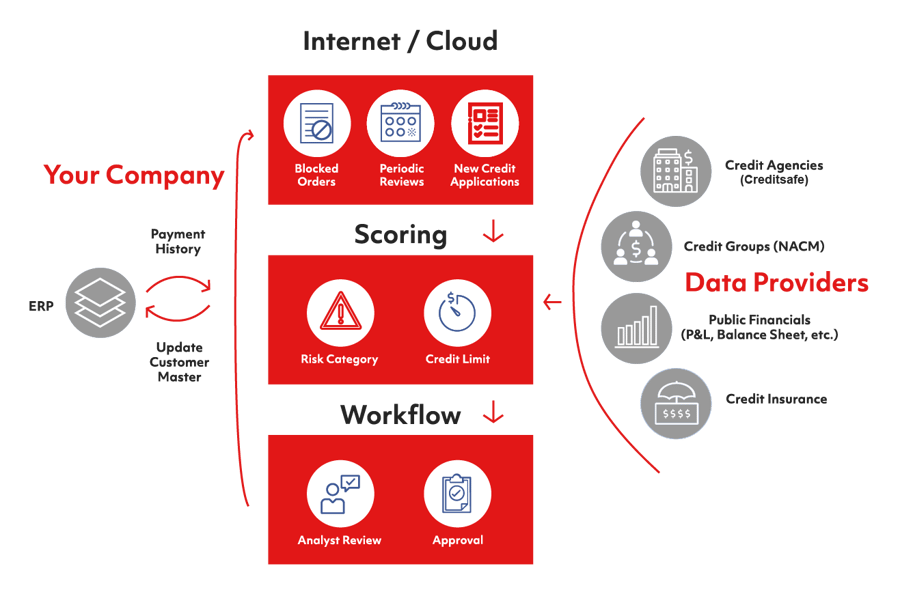

HighRadius Credit Cloud automates the credit management process, enabling credit managers to make quicker and more accurate decisions with the 4 Cs

Configurable online credit application

Moving applications online simplifies the distribution process and eliminates issues with omitted or incorrectly entered credit information.

Customizable credit scoring engines

Build versatile credit scoring models unique to the requirements of your company’s credit policy.

Credit agency data aggregation engine

Credit agency reports, public financials, and other decision inputs are automatically gathered and made readily available with the application and during periodic reviews.

Collaborative credit management workflow

A collaboration platform drives efficient approval hierarchies with both customer and internal notifications about credit decisions.

Speed up credit application processing by capturing complete and valid information for new credit applications from your customers with an easy-to-use, customizable form which is capable of syncing directly with your credit management systems.

Automate the retrieval of essential credit reports and information from all leading agencies such as Creditsafe, credit insurance data providers, and public financials.

Simplify credit scoring with models customizable across geographies and customer segments with the ability to automatically assign credit limits for low-risk, high-volume customers.

Standardize workflows for credit management, and collaborate with external stakeholders including sales, customer service for customer on-boarding, periodic reviews, blocked order release, credit limit assignment, collateral renewal, and approval of credit requests.

Ensure process compliance by ensuring that important credit decisions are approved through the right hierarchy and stakeholders.

Fast-track credit application processing by automating correspondence with customer-provided bank and trade references and tracking responses.