With 22 years of experience at Creditsafe in the UK and USA, Michelle is a seasoned professional who thrives in our dynamic environment of evolving data, technology, and solutions. She particularly relishes the opportunity to work closely with customers, as evidenced by the numerous glowing references she has earned throughout her career.

Trade credit applications are an essential part of running a business these days. Why? Not all customers will have enough cash to pay for your goods and services up front. In most cases, they’ll want to apply for trade credit.

This is where things tend to get messy. We’ve heard from so many companies that still process trade credit applications using physical paperwork and manual processes. To put this into context, we recently surveyed finance teams to get a better understanding of the credit decision process in companies. What was especially interesting is that, for 63% of businesses, up to 5 people are involved in making credit decisions on new customers. And 75% of finance teams take up to a full day (8 hours) to reach a credit decision on a single customer.

When you look at our research, it’s clear that doing things the way they have always been done and relying on manual processes isn’t going to work anymore. Something needs to change.

While we get that not every company can afford to use digital tools and automated processes, it doesn’t require a massive investment. And the costs are well worth it when you consider what you’ll get as a result – more customers signed on, a smoother customer onboarding process and more accurate, reliable credit decisions made. And the more accurate and reliable your credit decisions are, the less risk your company is exposed to. It’s a win-win.

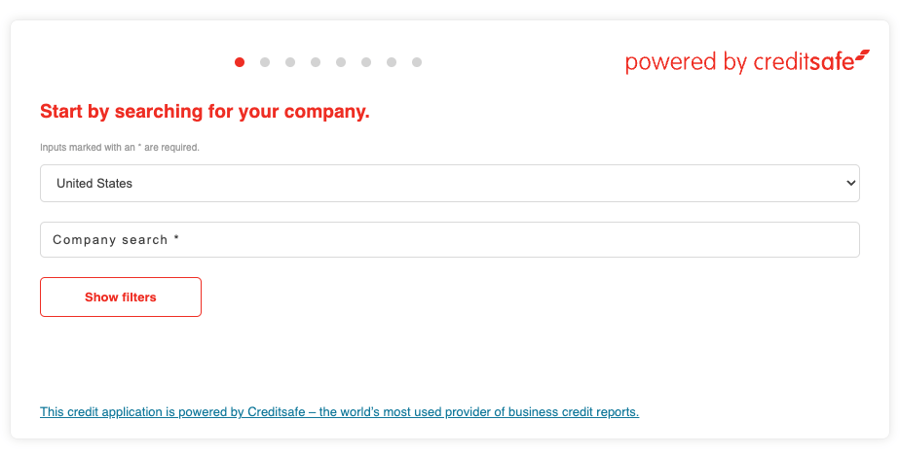

This is why we partnered with Harbr to streamline and improve the online trade credit application process. How exactly have we done this, you might be asking? Well, we built a new digital trade credit application tool.

What you can expect from the trade credit application tool

The credit application tool seamlessly integrates with our business credit reports API, providing real-time access to vital company information, financial health metrics, creditworthiness, trade payment data and more. No matter how big and trustworthy a company may seem on the surface, there’s no substitute for reviewing credit risk data.

What makes this tool more reliable is that it uses our Check & Decide solution in the backend to make it easy, quick and effective for finance teams to build automated workflows based on the company’s credit policy. This means the credit decisions recommended by the tool can be used and trusted with confidence.

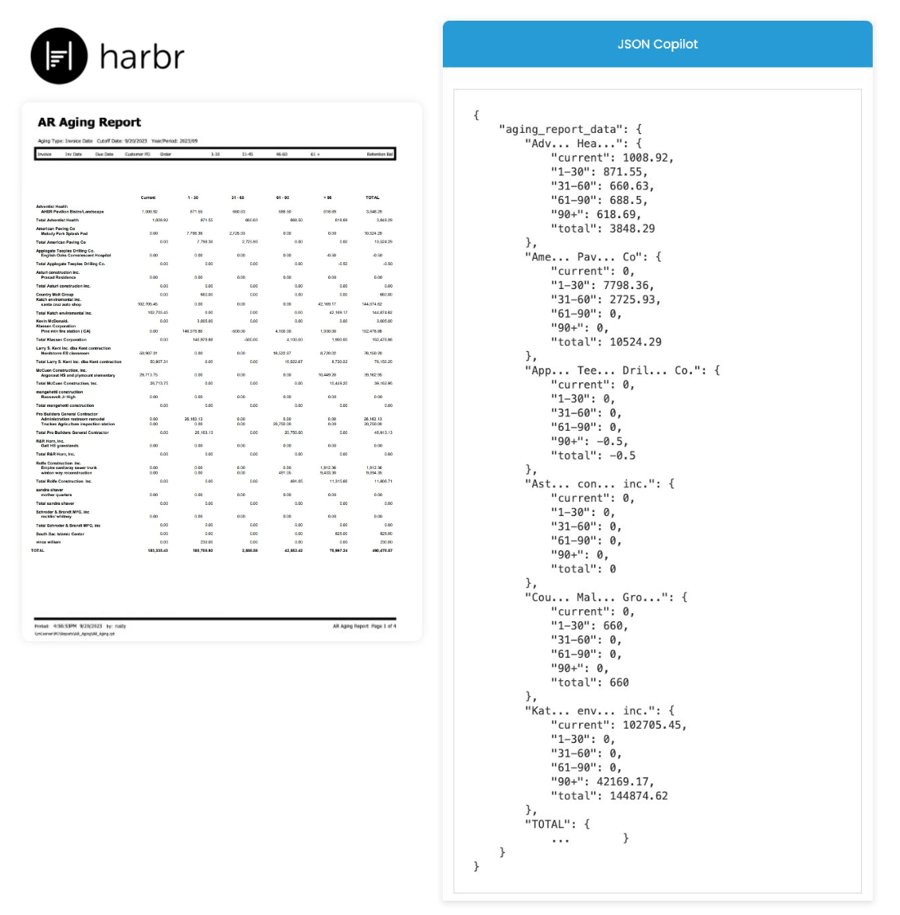

When it came to building the credit application tool, we quickly identified Harbr as the ideal partner. They have extensive experience in document AI, which is something we wanted to offer as an optional add-on to the tool’s capabilities. The reason we wanted to do this is because the document AI and data enrichment features will make it easy to automatically extract information from file uploads, such as financial statements, trade references and other relevant documents. So, it will be much quicker to gather and analyze data with this new credit application tool than it is in most companies today, where finance teams have to sift through a plethora of physical and digital documents. And it will lead to less errors when inputting the information into the credit application.

To delve deeper into what this partnership between Creditsafe and Harbr means and why it will help businesses better identify and avoid risks, I sat down with Dave Kim, CEO of Harbr. Here are some snippets from our chat.

Say goodbye to long, tedious and unreliable credit decision processes

What’s the biggest frustration companies have with their trade credit application process?

Dave Kim: We’re in 2024 and there are still so many finance teams who are using manual processes and physical paperwork to manage trade credit applications. I’m not trying to shame any of these companies. Often, this is just out of necessity – be it due to limited budgets, hiring challenges and difficulty getting buy-in for implementing certain tools and automating processes.

But trying to reconcile financial data by sifting through dozens (sometimes hundreds) of emails isn’t just a time-suck; it’s going to lead to errors. If the wrong data is entered into a credit application, or if vital financial data is missed and not included in the application, the decision’s reliability will be affected. That’s what I want companies to really understand.

It’s less about being digitally-savvy and more about using technology to cut out unnecessary errors and strengthen the quality of data. That’s what we want finance and accounting teams to think about when they’re debating whether or not to use an online credit application tool. The pros are undeniable.

How do manual processes end up skewing the accuracy of credit decisions?

Dave Kim: Think about it this way. Imagine you’re a restaurant that goes through thousands of towels, uniforms and cloth napkins each week. How long would it take staff to hand wash every single item each week? A very long time (and that’s assuming the restaurant has enough workers to handle the volume of washing and drying). How likely is it that stains wouldn’t be caught and would make the restaurant look unprofessional and unhygienic? Very likely. Would the restaurant be able to rely on having enough towels, uniforms and cloth napkins for service every night? Probably not.

A more effective option would be to use a service that can process the washing and drying of the towels, uniforms and cloth napkins at a high volume, while also doing so with the highest care and quality. When the restaurant does this, it’s not just about saving time. It’s also about making sure their customers have a positive experience.

This analogy applies to the trade credit application process. By using an online credit application tool like the one we built with Creditsafe, businesses can save time and money, while also improving the customer onboarding experience and protecting their own business from risks.

Software, AI and privacy-preserved computing is now at a stage where context-based decision-making (i.e. parsing through email threads and keeping track of changes/confirmations/denials) far exceeds what we as humans can do in terms of efficiency and comprehension. While the use of digital trade credit application software may be in its early stages, it’s only a matter of time before it becomes a holistic commodity.

Do you think finance departments are ready and willing to embrace automation?

Dave Kim: There’s research that shows that finance teams historically haven’t been too keen on using technology or automating processes. But I know from first-hand experience that this is changing more and more. I speak to finance teams regularly and many are now strongly advocating and working to get buy-in and budget approvals to use technology that makes their jobs easier and helps them make better sense of the data they need to do their jobs.

Do I think every finance team is a proponent for technology and automation? No. But I know they’re on the path to believing in the power of technology and automation. I think the best way to get finance teams to change their minds (or see the value) is to show them the amount of time they could save every day, week, month and year by automating many of the processes that are currently being done manually. And if you can show them how automation will make their job both easier and help them perform their job better, that’s where you’ll start to see a change in mindset.

About the Author

Michelle Regan-Zamora