Steve Carpenter oversees business operations, sales, P&L, product and data. With an impressive 16-year tenure at Creditsafe, Steve has played an integral role in the company's international expansion efforts, spearheading global data acquisition and fostering global partnerships.

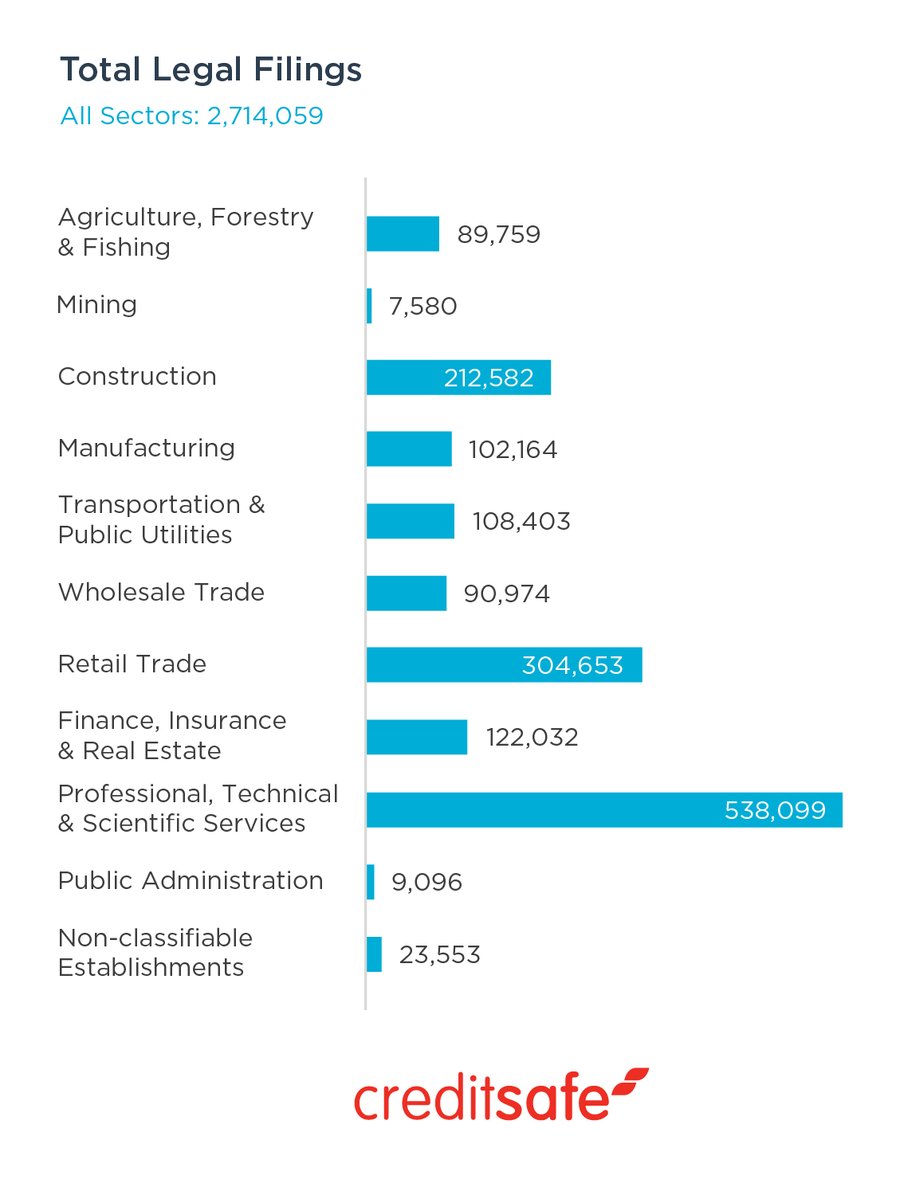

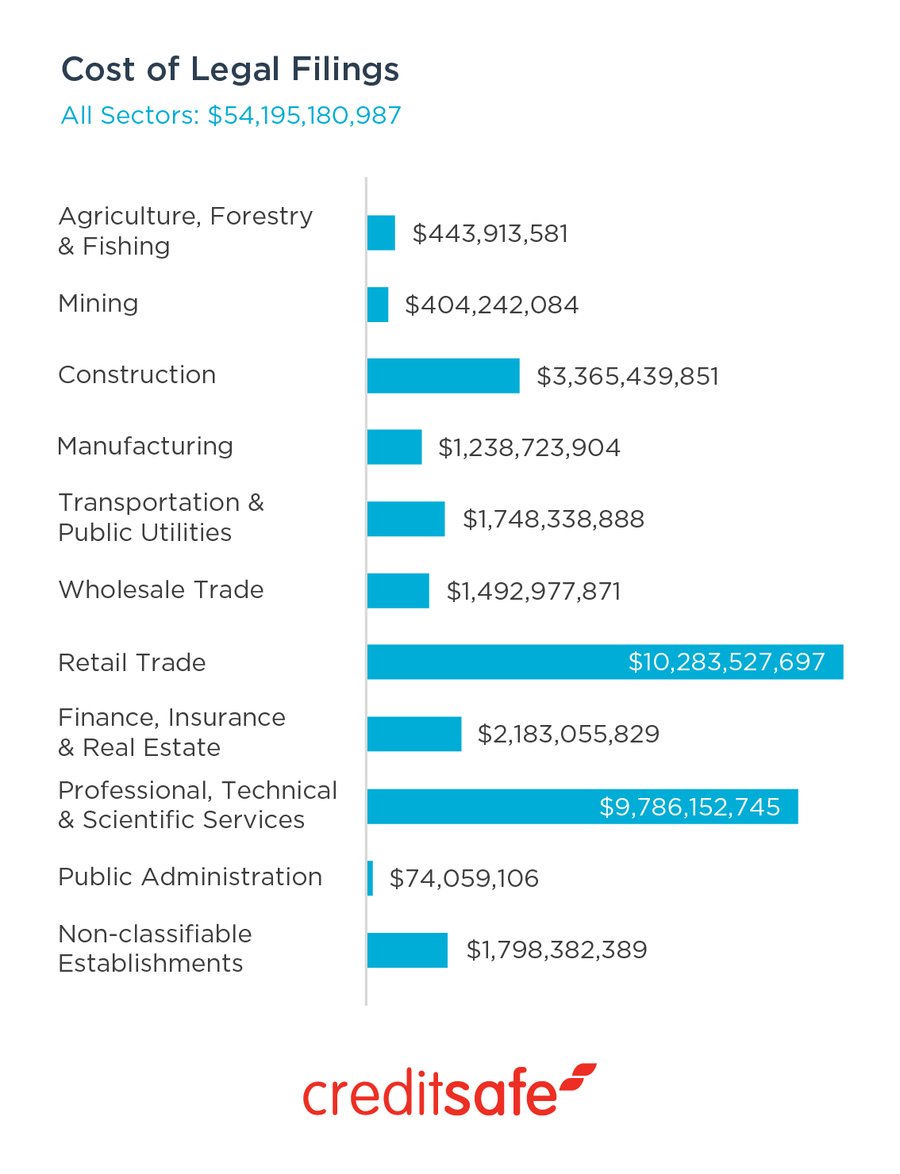

If I told you there were over 2.7 million legal filings against American businesses in 2022, would you believe me? What if I told you that these legal filings drained American businesses of over $54 billion?

As much as it pains me to say it, these findings are true. Our new ‘State of Credit Risk: 2022’ report uncovered these and other findings, including which sectors were the most reliable and creditworthy and how well small, mid-market and large companies paid their bills.

So, let’s get back to the data, shall we? There were a few trends that surprised me, but also made me wonder what was causing these trends.

The retail, professional services and construction sectors found themselves in the most legal trouble.

The three sectors with the highest number of legal filings were: professional services, retail and construction – each with over 200,000 legal filings last year. And when we drilled even further into the data, we saw that retailers were hit the hardest, losing over $10.28 billion alone to legal filings. Professional services firms followed close behind, losing over $9.78 billion, while construction companies came in at a distant, but still notable third spot, losing over $3.37 billion.

It's important to note that legal filings include court judgments, lawsuits, tax liens and UCCs (Uniform Commercial Codes). A federal tax lien is the government’s legal claim against your property when you neglect or fail to pay a tax debt. The lien protects the government’s interest in all your property, including real estate, personal property and financial assets. The truth is that every business has the power to prevent being served a Federal Notice of Tax Lien. If your finance/accounting team has the right financial policies, systems and automated processes set up, then it should be relatively simple to file your business taxes properly, accurately and on time.

The bigger issue here is that a tax lien lets the government skip the line and get paid for their debt before any other creditors that you owe money to. This means that if your business fails and you have a tax lien, your other creditors may end up with nothing. So, lenders are likely to look at this information in a company’s business credit report before deciding to loan the business money. The presence of a tax lien on a business credit report won’t give lenders much reassurance that the company will be able to repay its debt in a timely manner.

Of course, there are various types of lawsuits that could be filed against a business. For instance, a business could have a class-action lawsuit filed by customers for a data breach that exposed their personal data. Also, it’s likely that big corporations have a significant number of lawsuits filed by employees for a variety of reasons, including discriminatory practices, wrongful termination, unpaid wages and other reasons.

According to a report from the law firm Duane Morris LLP, the workplace plaintiffs’ bar scored settlements worth nearly $2 billion combined in 2022 and had a high success rate with cases around employment bias, employee benefits and wage/hour cases. With the recent news of mass layoffs from many of the tech giants, including Microsoft, Twitter and Google, I have a feeling there will be an uptick in employee lawsuits this year.

Matthew Debbage, CEO of the Americas and Asia for Creditsafe, had some interesting things to say about legal filings and how they can indirectly lead to business failure and bankruptcy.

“While legal filings don’t directly cause bankruptcies, they can add to the tall pile of problems pushing a business towards bankruptcy. And they’re often seen as a major red flag by lenders if you’re trying to secure funding or get approved for a business loan. Bed Bath & Beyond is a prime example of this. Amidst fears of bankruptcy, the retailer disclosed in their latest quarterly filing with the U.S. Securities and Exchange Commission that they’re in default on loans as of January 2023.

When I heard this news, I couldn’t say I was all that surprised. Our data shows that Bed Bath & Beyond Inc. has 18 UCC filings against it, with the latest one filed in June 2022. UCC filings allow lenders to seize listed property as a way of recouping loan funds in case a borrower defaults. While UCC filings didn’t directly cause Bed Bath & Beyond’s financial troubles, they certainly have affected the company’s ability to get funding. After failing to find a buyer, the retailer is now proposing a stock offering that could inject more than $1 billion into the company. This last-ditch effort could have been avoided if they had kept their legal house in better order from the start.

But that doesn’t mean there aren’t things business leaders can do to anticipate and prevent legal filings. The first step is to make sure you have a thorough understanding of all the legal requirements. I’m talking about employment/labor laws, tax laws, compliance laws, financial reporting requirements, data privacy laws and any other laws that are relevant to your business. A big part of getting this right is hiring people with the right skillsets internally to stay on top of all financial, legal and compliance matters that impact the business. And if you can’t afford to hire these roles in-house, you need to hire financial consultants, corporate attorneys and compliance specialists who can help protect your business.”

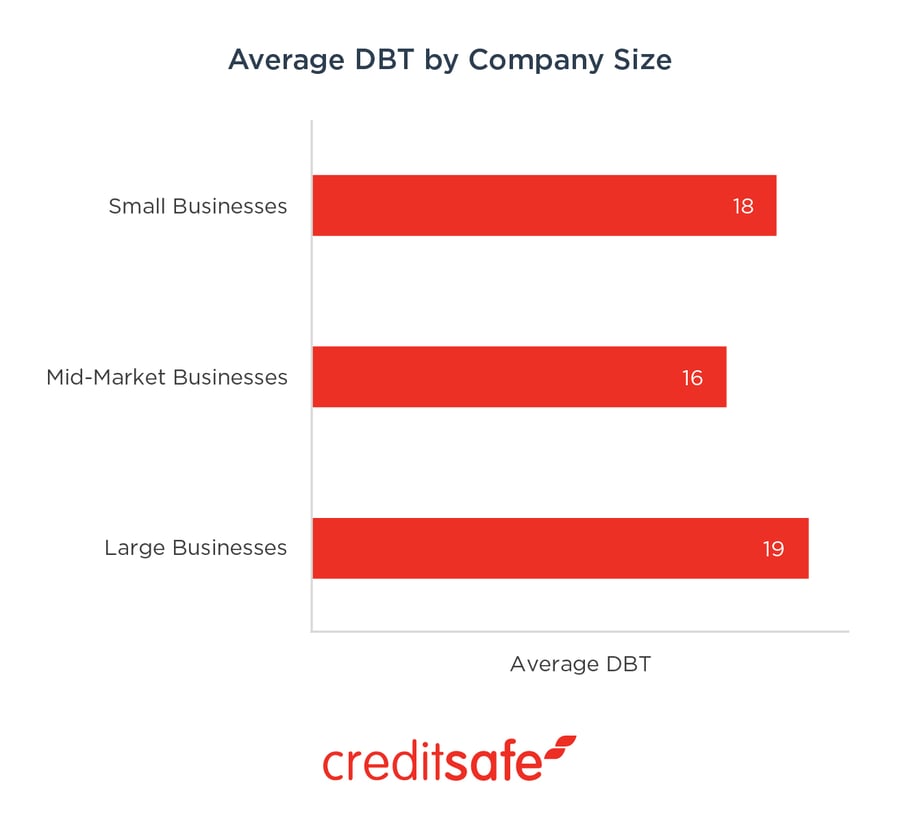

Bigger isn’t always better: large businesses are the worst at paying invoices on time.

As our ‘State of Credit Risk: 2022’ report found, closing a deal with a large business isn’t all that it’s cracked up to be. While your sales team is giving each other high-fives and celebrating the win, there’s a high likelihood that the business won’t pay its invoices on time.

As our data reveals, large companies are the worst at paying suppliers on time, with an average DBT (days beyond terms) of 19 in 2022, compared to small businesses (18) and mid-market businesses (16). This just goes to show how important it is that you do your own due diligence and run the numbers to make sure customers can actually pay their invoices in full and on time. But the sad truth is that most businesses don’t do this because there’s this assumption that the bigger the company is, the more reliable they are. But our data and our experience proves this just isn’t true.

And given the current economic uncertainty, no business can afford to not get paid on time (or at all). Since large businesses had the worst DBT in 2022, I couldn’t help but wonder if the economic downturn will worsen the situation for big companies and cause their average DBT to increase even more.

But as Matthew Debbage explains, it’s not that simple. “It will really depend on a few factors. If large companies are proactive and deliberate about paying their debts in full and on time, that could certainly help bring their average DBT score down and improve their overall credit risk level.

The truth is that many large companies deliberately choose to pay suppliers late for various reasons. For one, they may want to earn extra interest on their accounts (that have large sums of money in them). It’s also possible that businesses in certain industries – like agriculture, manufacturing, mining and construction – are purposely holding back some cash in their accounts to pay for anticipated machinery/equipment repairs and replacements. In these industries, machinery and equipment are often large in size, complex to use and expensive to buy (and replace parts or the entire thing).

Another factor that could tip the scales in a positive direction for large companies is if they see an uptick in sales and revenue in 2023. But again, increased sales alone won’t be enough to drive business growth, especially if a company has over 200,000 legal filings (like with retailers, who lost $10.28 billion alone as a result). And if there are supply chain disruptions or suppliers raise their prices, that could drive up the average DBT for large businesses.”

Companies can learn a thing or two about cash flow management from Trader Joe’s and Amazon.

Although our data shows that large companies aren’t the most reliable and tend to pay their invoices later than mid-market and small businesses, that doesn’t mean all large businesses do the same. There are certainly some large companies that are being proactive about managing their cash flow so they don’t end up paying suppliers late.

Trader Joe’s is a prime example of a brand doing a lot of things right – with its employees, its customers and its suppliers. It’s often referred to as a ‘supplier’s dream account’ because it pays on time and doesn’t charge suppliers extra for advertising, couponing or slotting fees (like other retailers do).

I’m not just saying that because others are saying it. Our data shows it to be true. Impressively, the supermarket chain (Trader Joe’s) has an average DBT of 0 and only pays about 3% of its invoices late. That’s impressive and not the norm with large companies.

Amazon is another hugely popular brand that’s doing several things well from a financial and risk management perspective. For instance, it has an international credit score of A (the highest score you can have) and has a credit limit of $50 million. And in terms of late payments, while it’s not as impressive as Trader Joe’s, it’s still relatively low – with an average DBT of 6.

I asked Matthew Debbage if he thinks it’s dangerous for businesses to blindly assume and expect large companies to be reliable and in good financial standing. He had some strong words of warning.

“Just because a business has thousands of employees around the world and has high brand recognition in the marketplace doesn’t automatically mean they have their finances in order. Large companies tend to have high operating expenses, costs, infrastructure and employees to think of (and pay for). It’s why we see mass layoffs at companies happening so frequently. And they often spend too much money without taking into account how much money is coming into the business. That leads to cash flow problems, which is one of the leading causes of business failure.

Earlier this month, Yahoo! Finance wrote about ’10 companies and industries that make money in a recession.’ While I’d agree with most of the companies listed, one of the companies stood out to me as potentially having issues in 2023 – The Home Depot.

For instance, our data shows that The Home Depot pays 37% of its invoices late and owes $365.2 million to suppliers. That is no small amount to owe suppliers. Plus, it has an average DBT (days beyond terms) of 9, which is a lot higher when compared to the average DBT (2) of companies in the same industry. This paints a not-so-great picture of the company’s financial health and indicates it may have a cash flow problem. It may also indicate that its DSO (days sales outstanding) is increasing – meaning that it’s taking longer to collect payments from customers. This may have to do with the fact that the retailer offers BNPL (Buy Now, Pay Later) payment options to customers. So, it may take longer for sales to make it into the retailer’s accounts.”

Economic uncertainty doesn’t have to be a death warrant for businesses.

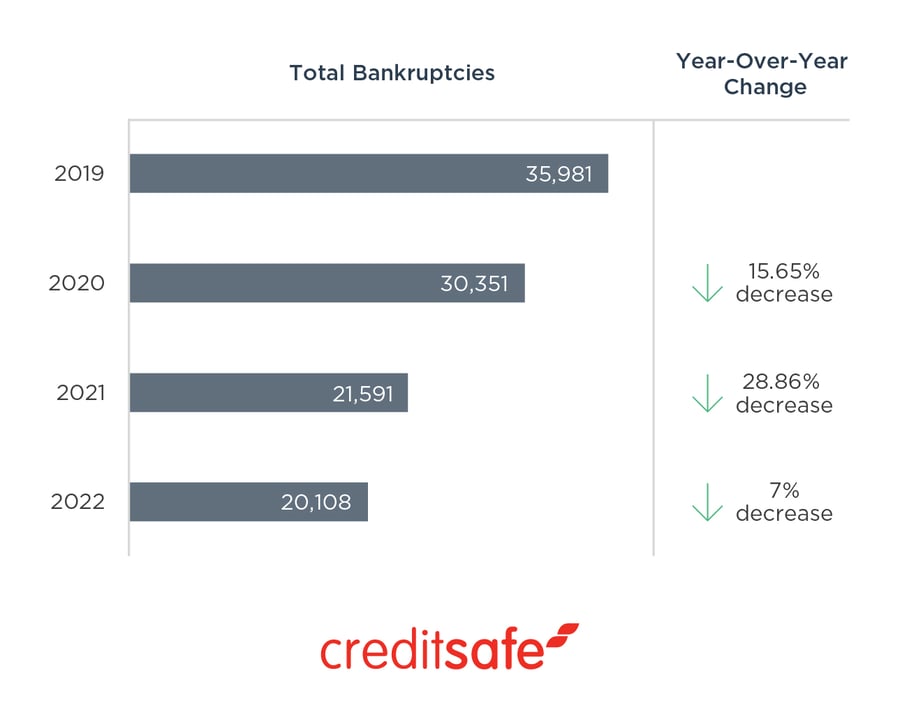

Despite the turbulent economy, our data shows that bankruptcies have fallen for three consecutive years. For example, bankruptcies dropped from over 35,000 in 2019 to just over 20,000 in 2022.

When I asked Matthew Debbage for his perspective on why bankruptcies have fallen, he reminded me that COVID-19 was at its peak from early 2020 through 2021, resulting in multiple lockdowns and business closures. But since the U.S. bankruptcy courts were closed during those times too (for months and months at a time), that meant that bankruptcy hearings couldn’t take place.

It’s also important to note that most small businesses in the U.S. don’t file for bankruptcy. Instead, they just shut down operations and close up shop. So, even though companies failed, that doesn’t necessarily mean it would lead to more bankruptcies.

Credit risk management is a marathon, not a sprint.

It’s impossible to definitively say a company could improve its credit risk profile in a certain number of weeks, months or years. It’s not that simple.

It’s not like a business with 300,000 customers globally can just flip a switch and fix their cash flow problems. That’s going to take time and it’s going to be the culmination of a lot of work internally by multiple teams – from finance/credit control to supply chain/procurement to operations to sales/revenue operations to the senior management team. It’s also going to require a comprehensive analysis of the company’s financial health and payment behaviors as well as creating credit risk profiles for its customers.

Trying to assign a timeframe for when a company can improve its credit risk profile isn’t the right attitude to have or approach to take. It’ll just lead to unrealistic expectations from business leaders. The key is to be strategic and data-driven in how you tackle this as a larger project – much like businesses have been doing with their digital transformation strategies. It makes me wonder why businesses aren’t prioritizing their time, resources and budgets on credit risk transformation strategies. Perhaps it’s time that becomes a top priority for businesses because our data shows something needs to change and it needs to change soon.

About the Author

Steve Carpenter, Country Director, North America, Creditsafe