Whether you’re a big business or a small business, it doesn't matter how many invoices you receive. Keeping on top of what needs to be paid and when payments are due can be a herculean task and one that can make or break your cash flow.

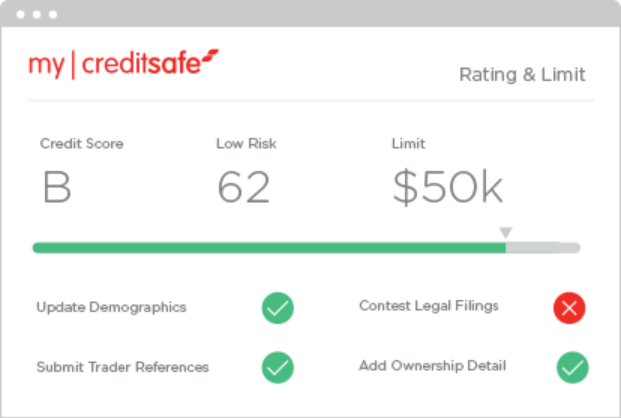

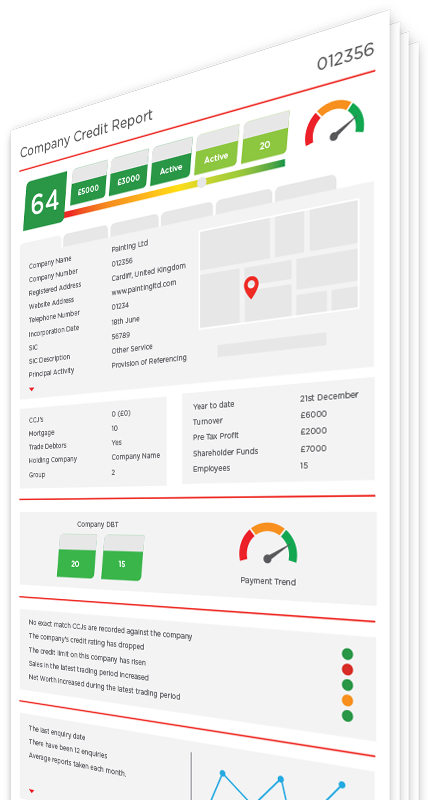

When we think of the consequences of late payments, the first thing that comes to mind is how it will impact our business credit score. While this is of course a very real thing to be concerned about, we also need to consider the reputational impact. After all, you don’t want to damage supplier relationships as this could have a very negative effect across the business.

Much like any project, everything can't be a top priority. You need to create a priority system for paying your invoices. The first step is to identify what's urgent, what can wait for a bit and what is the least urgent. Sort your invoices into most urgent, somewhat urgent and least urgent categories - and do this based on the payment terms that have been set and due dates. Of course, if you have thousands of invoices coming in weekly it can be a difficult task to get those payments made on time and in full.

It’s also important to make sure every invoice matches its corresponding purchase order. After all, you don’t want to pay an invoice until you can confirm the product or service has been received and aligns with the amount listed on the invoice.

You should also keep an eye out for early payment discount opportunities, as suppliers regularly offer these types of discounts. AP automation makes this easy and speeds up the approval process. On top of that, it also helps you identify and take advantage of early payment discounts. If there aren’t any opportunities within the current contract, then these discounts should be explored when it comes time for contract renewal.