How much can a single data point tell you about a company? Well, it depends on which data point you’re looking at. Days Beyond Terms, or DBT, for example, can give you a peek into several different issues a company might be facing. Since DBT is the average number of days a company pays their suppliers past payment terms (or, in plain English, late), seeing a rise in DBT might have red flags dancing behind your eyes.

If a company’s DBT is high (over 45) or increases drastically in a short period of time (i.e. rising from 10 to 45 in a single month), you should pay attention to this. What could change in a single month to cause them to take so much longer to pay their suppliers? What could be happening in the background in their finance operations that’s making it harder to pay their bills on time? Could these late payments be a symptom of something larger and be a precursor to financial distress?

Unfortunately, late payments aren’t that uncommon these days. Our recent study, Perils of Rising Debt and DSO, found that only 14% of businesses have most of their invoices paid on time by their customers. Plus, a staggering 61% of businesses reported their customers were paying their invoices between 31 and 90 days past payment terms.

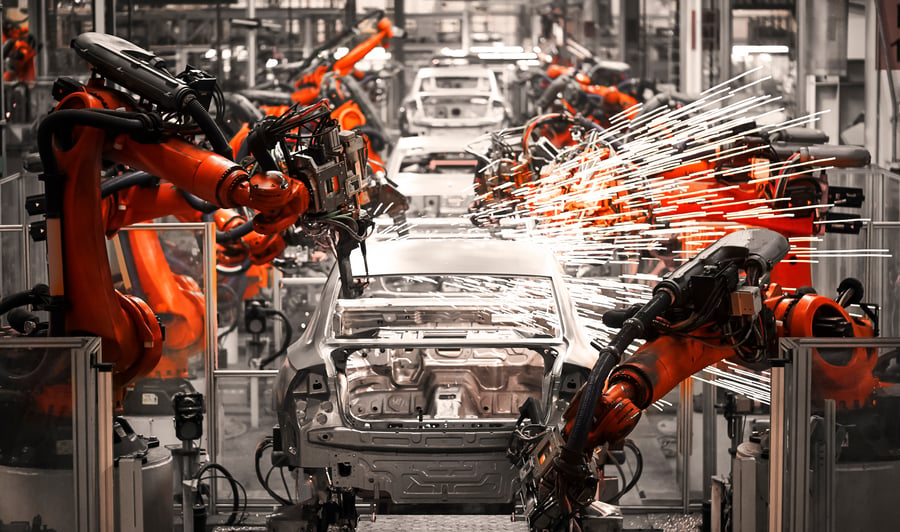

Manufacturing companies, in particular, have been hit hard by this rising tide of late payments. A 2023 research conducted by Taulia revealed that over half of the 11,300 suppliers polled admitted to receiving delayed payments from their customers that year. The research also predicts that this number of late-paid suppliers is expected to further spike in 2024 amid the uncertainties of global conflicts like the Red Sea attacks and high interest rates that will continue to disrupt supply chains this year.