In the world of sales, leads matter a lot. Salespeople need to target the right leads and then convert them into sales deals.

Their entire job revolves around this. But far too often, salespeople chase after any and every lead even when they have a track record of paying invoices late and have poor business credit scores. These are clear red flags to the finance/credit control team, but they often get overlooked by salespeople in large part because they’re so focused on hitting their monthly targets.

But overlooking these types of red flags isn’t just dangerous for the business, it’s also a time-suck and can make it tough for salespeople to close deals and limit revenue growth. The data from our new research study, “The Sales vs. Credit Control Battle” shows this to be very much the case.

For context, we surveyed over 350 sales managers working in enterprise businesses in the United States to better understand how they use the data in their CRM platforms to vet leads, the quality of CRM data available to them and how that CRM data quality impacts their sales productivity and performance. We were also keen to understand the level of alignment and communication between sales and finance teams and how that impacts the company's revenue growth.

4 findings from our study that you can't ignore

There were four notable findings from our study that reiterate my point.

- STAT: 54% of sales managers waste up to 20 hours each week pursuing leads that don’t meet the company’s credit policy.

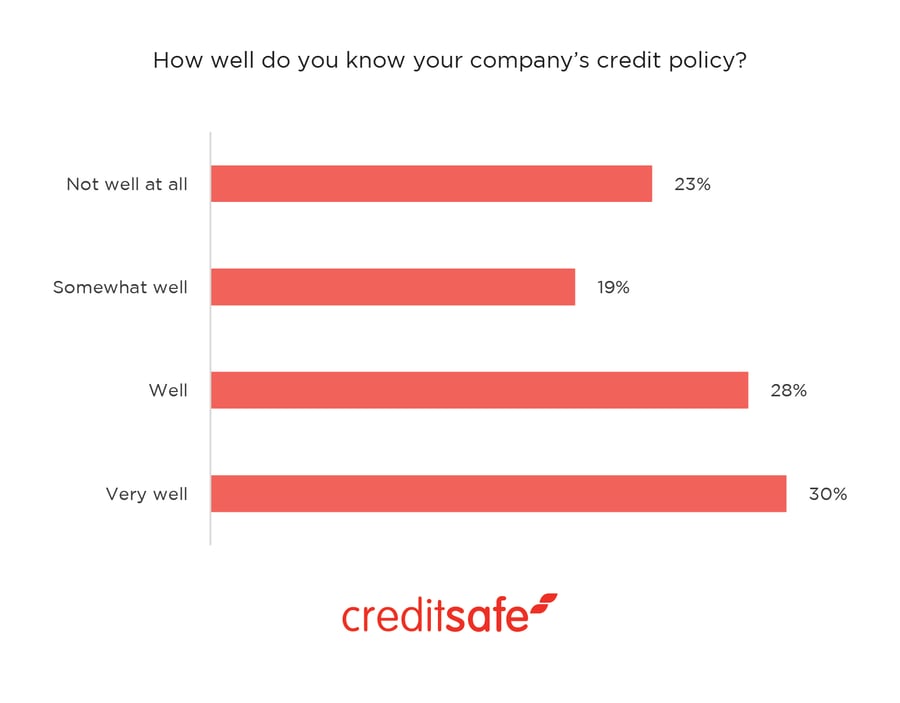

- STAT: 42% of the respondents have little to no understanding of their company’s credit policy.

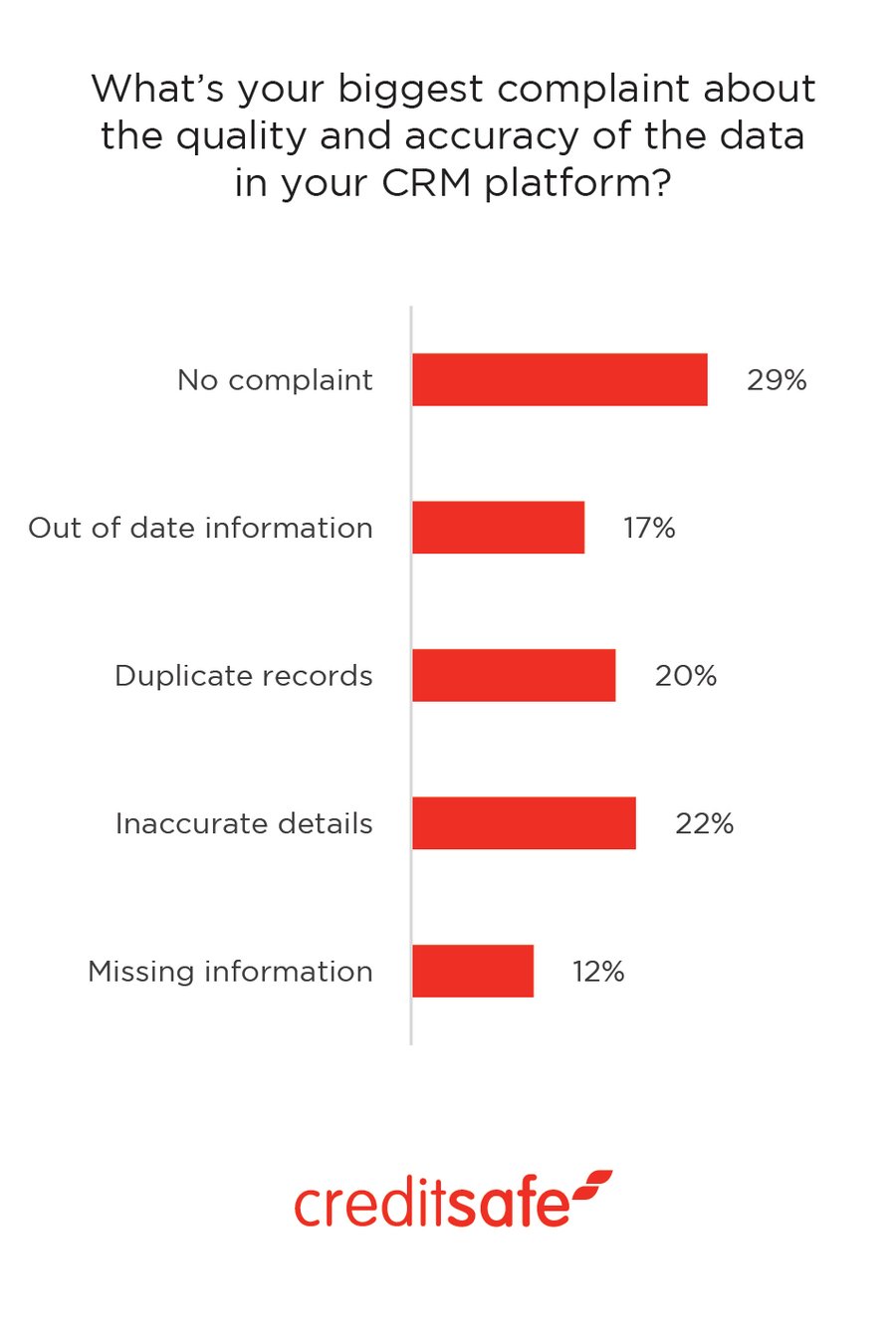

- STAT: 71% of sales managers are frustrated with the quality of CRM data in their organizations, citing issues with inaccurate information, duplicate records, outdated details and missing information.

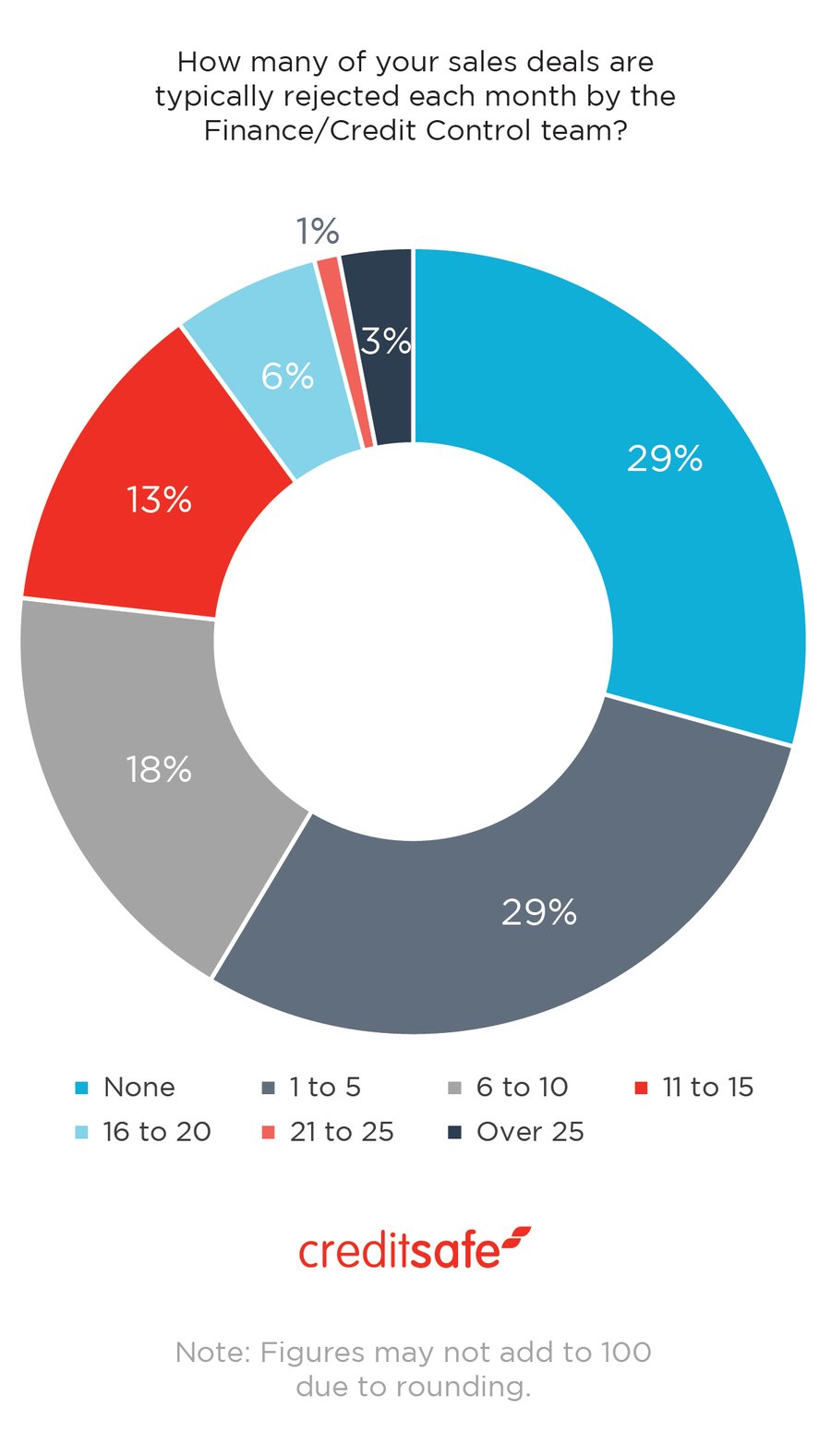

- STAT: 47% of sales managers have up to 10 sales deals rejected each month by the finance team because prospects don’t meet the company’s credit policy.

There’s a lot to unpack from these stats for both sales operations/enablement teams and finance/credit control teams. So, I sat down with Matthew Debbage, CEO of the Americas and Asia for Creditsafe, to get his take on some of the report’s findings.

STAT 1: 54% of sales managers waste up to 20 hours each week pursuing leads that don’t meet the company’s credit policy.

Ragini Bhalla: That's a pretty startling stat. Is this due to companies tracking the number of activities for a commission or lack of financial data? Or is it both?

Matthew Debbage: Every sales team has targets and needs to perform a certain number of activities to hit those targets. That’s just the nature of the sales role. But the fact that 54% of the respondents in our study said they waste up to 20 hours each week chasing down leads that don’t meet the company’s credit policy has to do with two specific things. First, the data typically pushed into CRM platforms doesn’t show the full story. Second, there’s a major lack of alignment with the finance/credit control team.

So, let’s talk about these two things. The first one has to do with the quality of data in CRM platforms. We know that sales teams rely on CRM platforms to do their job – they need that data to target, engage with and eventually convert prospects into sales deals.

But the truth is that the typical data pushed into CRM platforms is usually focused on information about prospects, such as their contact info, their roles at the given companies, the quantity and types of interactions they’ve had with salespeople, the types of content they’ve engaged with and other similar information. All this information is, of course, important for salespeople to do their jobs properly. But it’s only one side of the story. A whole other side of the story is missing – making the data less reliable and useful.

Most typical CRM platforms don’t include information about the financial health of prospects and existing customers, such as how well they pay their bills, how many of their bills are past due, how much money is still owed to vendors, their business credit score, their credit limit and other similar information. But this information is, in fact, extremely important in preventing the company from working with customers who are unreliable, habitual late payers with low business credit scores and too much debt extended. And this is the information the finance/credit control team in organizations looks at when deciding whether to approve or reject a sales deal.

So, by having this data integrated into CRM platforms, it’s not just a win for the finance team. The sales team wins too because they’ll have less deals rejected by the finance team – that means more revenue for the business and more commissions earned.

The second issue is that the sales and finance teams aren’t aligned with each other. While 21% of the respondents in our study said their company doesn’t have a credit policy, 18% said they don’t even know if there is one at their company. To make matters worse, 42% of the respondents confirmed that they have little to no understanding of their company’s credit policy. This indicates that there needs to be better alignment and communication between sales and finance teams.

If sales teams don’t know if a credit policy is in place, but in fact there is one, it’s important to share this information and make sure the sales team understands the parameters used to decide whether a sales deal is approved or rejected. Not knowing if a credit policy is in place is bad enough. But when you add to that the fact that nearly half of the respondents don’t understand the policy well at all, this could increase the likelihood that sales deals are rejected often.

STAT 2: 42% of the respondents have little to no understanding of their company’s credit policy.

Ragini Bhalla: How can companies prevent this from happening and who does the responsibility fall on?

Matthew Debbage: When I saw this stat, I was both surprised and disappointed. It shows that there’s a real divide between the sales and finance team in many organizations. While it’s certainly bad enough that they’re not communicating with each other, this lack of communication could lead to massive revenue leakage.

There are several ways to prevent this from happening. First, the two teams need to work together to mend their fractured relationship. It’s not going to happen overnight. But it will happen eventually if both teams come to the table with an open mind, a willingness to listen to each other and a curiosity to understand the motivations and goals of each team.

From there, the finance team needs to take ownership of not just creating a credit policy but also documenting it, sharing it and hosting interactive sessions with the sales team to help them understand what’s included in the credit policy – the factors they consider, the reasons those factors are deemed high risk and why those factors could hurt their earning potential and ability to close deals. It can seem like just sending a large PDF of the credit policy to the sales leader should qualify as sharing the policy. But it’s not. More often than not, that PDF will just sit in the inbox unread – or even deleted – by salespeople.

It’s important for the finance team to do these types of interactive sessions to show them why the credit policy exists and include real-world scenarios they’re likely to encounter with prospects. Remember, salespeople are motivated by money and are measured by their ability to close deals – so, finance teams should talk in the language salespeople will understand.

This doesn’t mean the sales team has no responsibility in this matter. Once they’ve been informed of and trained on the credit policy, they need to make sure they’re looking at the necessary financial data early on so they aren’t wasting hundreds of hours chasing a deal that will end up getting rejected by the finance team in the 11th hour. And if they don’t have this type of data available, then they need to push their sales leader or technology leader to bring on the right tools (or integrate with a platform that has credit risk data).

One thing to remember is that it’s not just the sales and finance teams’ responsibility to remedy this situation. It’s everyone in the organization’s responsibility. Ultimately, it needs to be driven and supported from the top leadership down.

STAT 3: 71% of sales managers are frustrated with the quality of CRM data in their organizations, citing issues with inaccurate information, duplicate records, outdated details and missing information.

Ragini Bhalla: How should teams audit their CRM platform without taking away from sales productivity?

Matthew Debbage: I wish I could say it was surprising that sales managers felt the quality of data in their CRM platforms was subpar, but it wasn’t. While that certainly matters, it’s more important that businesses audit the quality of their CRM platforms regularly.

But salespeople themselves shouldn’t be doing the auditing. That needs to be done by someone in sales operations, which is a function that most modern B2B organizations today have in place. In some cases, the sales operations leader might need to work with someone from the technology/IT department to audit the overall tech stack. Nevertheless, salespeople are on the front line talking to prospects share some of the responsibility to update the CRM with accurate information.

But salespeople shouldn’t be completely removed from the auditing process either. Their input and feedback into their challenges, priorities and goals should be taken through both regular feedback surveys and informal interviews. That should then be used to determine what’s the best way forward – whether you scrap your existing platform for a new one altogether or whether you need to look at integrating your existing platform with a credit risk intelligence platform so your salespeople have the full data picture needed to close more deals without putting the company at financial, legal and compliance risks.

We make sure that businesses are getting the best quality data by providing credit risk intelligence on over 365 million businesses in over 160 countries. We also have a matching algorithm for 17 countries and help businesses enrich their account and lead records with 32 fields. On top of that, our data is updated up to 5 million times a day to include credit scores and limits, financial information on up to three years of annual accounts, bankruptcies, judgments and lawsuits. Our data is trusted and used by over 110,000 businesses worldwide, including BMW, Volvo, Viacom, Panasonic and Nestle.

STAT 4: 47% of sales managers have up to 10 sales deals rejected each month by the finance team because prospects don’t meet the company’s credit policy.

Ragini Bhalla: How can sales professionals change their mindset from prioritizing prospects that have an immediate product need or high purchase intent to determining financial health and their ability to pay on time?

Matthew Debbage: I don’t think it’s an either/or type of situation. Every company wants their sales team to be successful because the more commission salespeople make, the more sales are made for the business. But wasting time chasing prospects that won’t get approved is a waste of everyone's time and can be resolved very easily.

Salespeople should still prioritize prospects that have an immediate product need or high purchase intent. But meeting this criteria doesn’t automatically make a prospect a ‘valuable’ prospect. It’s about doing your due diligence in parallel.

So, while you’re pursuing a prospect with high intent/immediate need, you’re simultaneously running a credit check on the business to see if they have a low credit score, if their credit limit is low, if they have dozens of legal filings and derogatory marks and if they’ve filed for bankruptcy in the past. It’s not going to take days to do this – it takes a matter of minutes if you have the right tool in place that integrates with your CRM platform. What’s great is that we’ve not only built a customized app in Salesforce (Creditsafe Business Intelligence Plus App for Salesforce), but we can also integrate with any other CRM platform through our Connect API.

Ragini Bhalla: Why haven’t more businesses recognized the issues with their traditional practices or CRM platforms? Is it an “if it’s not broken, don’t fix it” type of mentality or is it a clearly broken/outdated part of their company?

Matthew Debbage: There are several reasons businesses don’t realize that the typical data being pushed into their CRM platforms doesn’t give the full picture. For one, salespeople are big on routines. They tend to do what they’ve always done – if it works, then why change it? In other cases, it may be that it’s what the company has been doing for years and no one has challenged it.

Perhaps the sales leader has told them they only need to use certain data in the CRM. So, it becomes a matter of doing what they’re told. And in many cases, the finance team doesn’t push for this type of data to be integrated into their CRM platform because they don’t believe the sales team will know how to make sense of and use it.

Another reason could be that salespeople don’t want to rock the boat by challenging the status quo and asking for something new/different. And in some instances, the company may know something’s wrong but they don’t have the budget, bandwidth and skillsets internally to implement a new platform or set up the necessary integration with a credit risk intelligence platform. Another reason could be that some businesses fear the idea – and cost – of change.

While these may be reasons for why bad data quality doesn’t get addressed in organizations, our study shows that bad data quality isn’t just annoying to salespeople. It’s also very costly, according to our study’s findings. Not only did 47% of the respondents report having up to 10 sales deals rejected each month by the finance team because prospects don’t meet the company’s credit policy, but another 52% said they lose up to $200,000 each month for this reason.

When you do the math, that could result in millions of dollars in revenue leakage. That’s definitely not something you want to happen, especially given the current economic climate and all the talk of a recession. If these stats are happening in normal circumstances, just imagine how much worse the impact could be in a recession.