We can help reduce your credit exposure by showing you the credit worthiness of the businesses you deal with anywhere in the world. Whether you’re extending credit to a business, offering a lease, or looking to improve the terms you receive on your contracts, our business credit reports are designed to help you make informed credit decisions so that you can protect your business from bad debt and outstanding invoices.

Reduce Your Business Risk with Business Credit Reports

Get answers to specific questions like:

-

How likely is a company to go bankrupt in the next 12 months?

-

How much credit can I feel comfortable offering a company?

-

Is a potential partner likely to pay me on-time?

-

Has anything changed that could affect my customers' ability to pay?

The data within a business credit report generally fits into three areas:

1. Scores and Limits

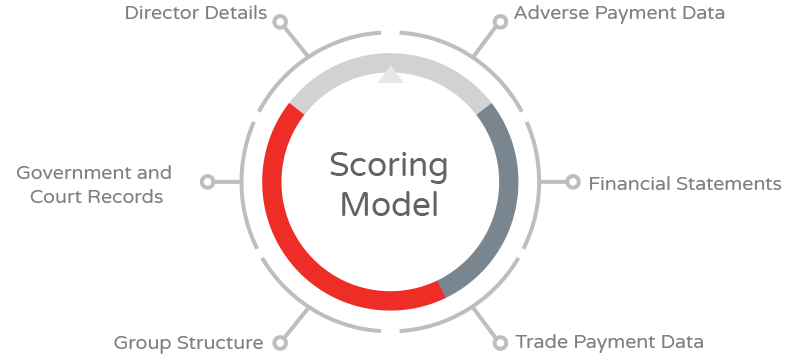

Our industry leading scoring system includes key statistical metrics and the most advanced statistical techniques to help determine the financial stability of a company.

Created by our in-house analytics division, the Creditsafe Credit Score is a statistically backed model using key data variables, including financials, trade payments, demographics, industry, legal filings, group structure, size of business and more, that have proven to have an impact when a business fails.

With our scoring model, we can predict 70% of company insolvencies 12 months in advance—saving you the financial worry that bad debt brings.

-

Credit Score

The Creditsafe Credit Score works on a scale of 1-100 and predicts the likelihood that a company's payment performance will become seriously delinquent, defined as 90 plus days beyond terms within the next 12 months or that the business will go bankrupt

-

International Score

The Creditsafe International Score is a standardized score derived from the Creditsafe rating. It enables credit risk comparison between companies that are registered in different countries.

-

Credit Limit

The Creditsafe recommended credit limit is calculated using information from a company's payment record and from the payment records of similar companies. The Credit Limit is a recommendation of the maximum amount of credit you should consider offering this company at one time.

-

Days Beyond Terms (DBT)

Our trade payment analysis that highlights how many days late a company pays their bills and how it compares to their industry.

-

Derogatory Legal

The number and value of tax liens and judgement filed in the last 6 years and 9 months plus bankruptcies filed in the last 9 years and 9 months

-

Payment Trend

Easily understand at a glance if there are any substantial changes in how they’re paying their bills

-

Business Spend Trend

Indicates whether the company's total annual business spend is increasing or decreasing compared to the previous 12 months.

-

Inquiry Trend

See how many other companies are viewing a report

Creditsafe is very much worth the yearly investment for us. As a small business, it is imperative to be able to continually check in on the credit status of your open accounts. As the AR Manager who wears many different hats, Creditsafe puts the information as an easy-to-access and understand report and alert. I plan on renewing year after year.

BAI Distributors Inc.

2. Core Business Data

The data within this section of the report can help you better understand any issues that may affect the company in the near future. Are there major executive changes? Is there an increase in the number of liens placed on the company?

To gain a better insight into a how a company operates, you need to know more about the people running the business. By reviewing information on the people leading a company, you can get a better understanding of where the business is going.

Types of Core Business Data included in our reports

-

Safe Number

Creditsafe's unique identifier for every registered company

-

Company Information

Includes any other legal names such as a DBA, address, phone number and website

-

Google Maps

Pin-point the exact location of the business

-

SIC Description

The Standard Industrial Classification is a system for classifying industries by a four-digit code

-

Business Type

Is the company a Corporation, Cooperative, Government, Incorporation, LLC, LLP, Non Profit, Partnership, or Sole Proprietorship

-

Location Type

See if the location is a Headquarters, Branch, Subsidiary, Franchise, Franchisor or Single Office

-

Officer Information

See the officers of each company and identify other know affiliations

-

Group Structure & Linkages

Corporate hierarchical structure identifying the head office, parent companies, subsidiaries and branches at a global level

-

Trading Locations

Identify any logistics concerns by knowing the full list of company addresses

-

Years in Business

Learn how long a company has been operating and its incorporation date

-

Annual Sales Amount

See how much revenue a company earned last year

-

Number of Employees

Total number of people who work for a company

-

Legal Filings

State and Federal Tax Liens, UCC Filings, Judgments and Bankruptcies

-

Government Award Information

Identify companies that have been awarded government contracts or grants.

-

Compliance Indicators

Key compliance indicators such as sanctioned business information.

-

Possible OFAC

Flag sanctioned businesses that the U.S. government prohibits from trading with under the Patriot Act

-

Federal Motor Carrier Safety Data

Understand transportation companies’ Motor Carrier safety ratings, fleet size and types of cargoes moved

-

Historical Data

See what's changed and when

3. Payment Data

Trade payment history is the backbone of a credit report as understanding how a company has managed their credit in the past is the key indicator of future performance. Companies with a long history of managing their business credit effectively are most likely to continue this pattern into the future.

Creditsafe’s reports all include Trade Data with millions of new payment experiences uploaded into our reports in our ever-growing trade database.

-

Trade Lines

Easily see how many other companies are known to be extending them credit and how timely they’re paying those bills

-

Financials

Directly link to financial statement information for public companies and nonprofit organizations based on income statements and balance sheets

Enhance a report with Financial Payment Data

Financial Trade gives unprecedented insight into the health of small and micro businesses so that Credit Managers can make the most informed decisions possible. Our Financial trade product leverages data that has traditionally been off-limits to business credit bureaus such as business leases, commercial credit cards and term loans.

Unique to Creditsafe you can request access to Financial Trade Data which includes accounts such as:

-

Business Lease

-

Commercial Credit Card

-

Letter of Credit

-

Line of Credit

-

Open-ended line of credit

-

Term Loan

When Financial Payment Data is available, we offer the ability to enhance a report

-

Enhanced Rating

Works on a scale of 1-100 and predicts the likelihood that a business’s payment performance for both financial and non-financial trade accounts will become seriously delinquent (90+ DBT) or the business will fail in the next 12 months.

-

Enhanced Credit Limit

Calculated using information from a company’s Financial and Non-Financial payment record and from the payment records of similar companies.

-

Financial Past Due

The total delinquent dollars (not including charged-off) on open and closed financial accounts

Where does the data come from?

At Creditsafe, we pride ourselves on the data and business intelligence we supply to our customers.

The data used to create our scores and limits comes from working with official sources such as Government entities and the Court System, and our selected global network of international data partners. To further increase the validity of our data, we include trade payment data from our trusted trade payment data suppliers to give you the most accurate picture of the financial stability of a company.

Global Monitoring Service

With Creditsafe’s Global Monitoring Service you’ll never again miss vital changes to the companies that you do business with. The system is highly adaptable and allows you to customize the alerts you receive to ensure that you’re only getting the most relevant notifications for your business needs.

Receive detailed email updates of any changes to US or international companies you have chosen to follow and how often you receive them. Countries available to monitor include: Belgium, Canada, Denmark, Finland, France, Germany, Ireland, Italy, Japan, Lithuania, Luxemburg, Netherlands, Norway, Spain, Sweden, Switzerland and the UK.

Monitor Your Companies of Interest:

- Monitor Your Company

- Monitor Your Customers

- Monitor Your Debtors

- Monitor Your Suppliers

- Monitor Your Competitors

-

Monitor US Companies

Receive email alerts on changes to: Credit score, credit limit, company status, DBT, bankruptcy, derogatory filing count or change, derogatory filing outstanding amount or change, possible OFAC

-

Monitor International Companies

Receive email alerts on changes to: International score, credit limit, company name, address, phone number, directors

-

Get email updates

Receive email updates that detail changes to companies that you are doing business with

-

Organize your alerts

Create portfolios of the companies you want to monitor and receive instant alerts to any changes

-

Choose what to be alerted on

You choose the information that you want to see from 17 different categories. Once you’ve chosen the information that matters the most to you, you can choose how often you receive these updates.

-

Choose how often you want to receive alerts

Once you've chose the information that matters the most to you, you can choose how often you receive these updates.

Global Coverage

We can deliver instant credit reports on over 430 million businesses in 200 countries.

Creditsafe is a reliable and easy to use source for all my third party credit verification. The monthly updates also help me keep up abreast of the latest information available

Mascoat Industrial

Try Creditsafe for Free Today

Your free trial will give you access to pull up to 5 domestic business credit reports **

Frequently asked questions

The Creditsafe scoring model works on a scale of 1-100 and predicts the likelihood that a business’s payment performance will become seriously delinquent, defined as 90-plus days beyond terms within the next 12 months or that the business will go bankrupt.

Your business credit score is calculated using the most sophisticated statistical algorithms available - taking into account over 150 parameters as well as economic and industry factors.

The information in the Creditsafe database is derived from multiple data sources including trade suppliers, demographic suppliers, government entities, court systems, and individual companies. This information is updated periodically throughout the year, from daily to monthly, depending on the data type. All information is verified before hitting our database and feeding the scores and limits that CreditsafeUSA provides our customers. As the information is verified and then loaded into our database, our scores are updated to reflect the new information. All scoresand limits are generated from our proprietary algorithms that are consistently refined based on advances in technology and process improvement.

Creditsafe international database reports are updated in real-time, over 1 million times a day.

No, we believe in providing all the data you need in one comprehensive business credit report to make an informed decision.

The credit limits within our Business Credit Reports are approved by all leading credit insurers. As an approved source, policy holders can use our recommended credit limits and integrate this into their discretionary policy limit or at a level advised by their credit insurance underwriter.