In the past, extended payment terms in business contracts were often considered a glaring red flag, indicating the possibility of ongoing cashflow problems, poor credit history, or, worse, a looming bankruptcy on the part of the buyer. All of which meant inheriting trouble when going into business with them.

However, in recent years, the tables have turned, and that too, in favour of large buyers. When working with manufacturers and suppliers, these buyers might often use lengthy payment terms or resort to delayed payments, sometimes for up to an average of 45 days from the agreed terms.

A 2023 study conducted by Taulia revealed that over half of the 11,300 suppliers polled admitted to receiving delayed payments from their customers that year. The research also predicted that the number of late-paid suppliers would continue amid the uncertainties of global conflicts and raised costs that continue to disrupt supply chains.

How do late payments disrupt the supply chains?

Long before lengthy payment terms became such an endemic problem, Supply Chain Dive called late payments a form of ‘financial bullying’; a common tactic among large retailers and businesses that often cripples the small to medium business suppliers, who have very little cushion against cashflow crises. The odds are often stacked against these suppliers as they feel compelled to accept longer payment terms, either to beat the competition and stay ahead of the game or due to the fear of lost sales.

Accepting these longer payment terms further offsets a supplier’s cash flow, with most of them extending their budgets, seeking unfavourable terms of credit, and performing at bare minimum standards, straining their relationships with customers and making them more prone to payment delays on the grounds of quality and assurance faults. It also impacts a supplier's ability to pay their ‘tier-n’ suppliers further upstream, eventually clogging up the cash flow in the supply chain and resulting in supply chain disruptions or, worse, with suppliers wounding up as insolvent.

What factors are causing late payments to rise?

The resurgence of late payment practices amongst top-tier businesses has long-term consequences on suppliers, supply chains, and the overall economy. However, what are the main factors behind late payments returning in global manufacturing markets?

1. Post-Pandemic Shift: From protecting suppliers to protecting working capital

Late payments have been an ongoing issue for the supply chain industry for decades. In 2019, it was reported that over $5 trillion was ‘locked’ up in unpaid invoices globally, with companies all across the world struggling with supply chain disruptions or accessing funding through cumbersome traditional banks.

However, during the pandemic, there was a significant change in payment habits toward suppliers. In the backdrop of the disruptions created in lieu of the transportation restrictions and COVID regulations, many businesses took action to protect their supply chains and their suppliers. They paid their suppliers on time or even early to prevent at least cash flow-related disruptions.

In the aftermath of the pandemic, the spike in energy and raw materials prices and higher transportation fees heightened the costs of some suppliers and their services. These inflationary pressures, combined with the threat of a looming recession, have compelled many businesses to protect their working capital and cash reserves over their suppliers – resorting to late payments as a preventative measure to the current fluctuating economic landscape.

2. Late payments are used as a cost-shifting measure

According to research published in the Chicago Booth Review, many large businesses make a strategic decision about which suppliers to pay late and how long to delay payment. The research also reveals that late payers are more often businesses with greater market power, who were guilty of making more late payments to ordinary suppliers but were more likely to pay their important suppliers on time.

Due to the inflation right after the pandemic, while many of these larger manufacturers or businesses awaited payments from their downstream customers, they shifted their costs by withholding payments from upstream suppliers. It is a common, strategic cost-shifting measure to maintain their standing in the markets while continuing to pressure their suppliers to uphold their service and delivery standards. Economists have stated that these late payment practices often change the role of these suppliers from being vendors of large businesses to now being de-facto lenders of them.

To throw light on the ongoing issue, Good Business Pays’ 2024 Slow Payment Watchlist revealed the names of big retailers like Coca-Cola and Ab InBev for taking well over 100 days to pay back suppliers. The list also mentions parent retailers like Air-Wick maker Reckitt and Cadbury-owner Mondelez for delaying payments for up to 126 days and up to 99 days, respectively.

3. Suppliers caught between the crossfire of Conflicts & Costs

Between geopolitical tensions, low demand, and mile-high transportation costs, manufacturers and suppliers are caught in a ‘perfect storm’ of factors that are beyond their control. Rising costs at their end, followed by late payments from their customers’ end, have landed them in a crossfire of financial troubles.

Taulia's report also revealed how machinery and chemical suppliers and manufacturers were the most impacted by late payments last year, with more than 60% of firms in these industries reporting that their invoices were paid more than 30 days late on average. However, the Wall Street Journal predicted that in 2024, freight, logistics, and ocean carriers and suppliers will be worst hit by late payments.

A major part of the problem is the rising cost of transportation. A series of geopolitical tensions, such as the Russia-Ukraine war and the Israel-Hamas conflict, have already offset many manufacturers and their logistics providers.

However, the world’s busiest trade corridors have posed the greatest disruption to global supply chains as of late. Vessels entering the Panama Canal have been restricted by authorities due to the lack of rainfall in Panama. Similarly, across the Atlantic, in the Red Sea, the Suez Canal has been adversely impacted by the Houthi attacks on the ships and carriers. The reshaping of inbound freight flows has added to the costs of route diversions, increasing shipping rates but also taking longer deliveries due to rerouting. These transportation disruptions further add to the payment delays and payment disputes toward suppliers due to the late deliveries despite the high costs.

4. Post-pandemic stagnancy in demand

The other part of the problem is lowered demand for goods in the aftermath of the pandemic. During COVID-19, many retailers and large manufacturers adopted a ‘just-in-case’ strategy of hoarding inventory, especially for goods where the inventory doesn’t necessarily need to be non-perishable or fresh, like electronics, clothes, and furniture. Due to this, many large retailers now maintain a stable inventory of these products, resulting in a lowered demand for their suppliers and carrier services in 2024. This has, in turn, increased competition amongst suppliers, and to keep their heads above water, they often agree to the lengthy or unfair payment terms posed by these retailers only so that they can continue doing business even in times of lowered demand.

How can suppliers avoid the trap of late payments?

1. With existing clients: Creating a risk-proof credit control framework

Many governments around the globe are introducing new policies to curb the lengthy payment extension clauses, particularly the ones imposed by large retailers who maintain a monopoly in the markets. For example, the U.K. introduced a “duty to report” bill in 2017 that forced large companies to disclose how long it took them to pay their suppliers. Similarly, this year state-level research revealed that half of unfair trading practices in the EU are correlated to agri-food products.

Following this, the EU banned 16 practices that have adversely impacted various parts of the food chain, including farmers and small suppliers. This list prohibits payments made up to 30 days late on perishable agri-food products and up to 60 days late on unperishable food products.

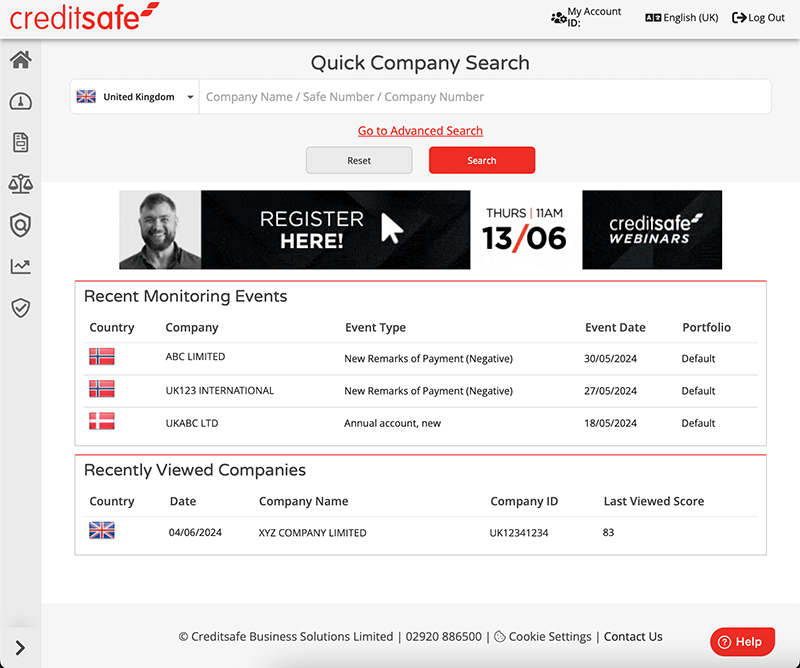

Outside of government policies, suppliers should also introduce a stringent credit control framework for their existing client base. This should include monitoring ongoing customers to flag any overdue payments, changes in their credit scores, or outstanding invoices.

These credit control policies should be further outlined in contracts through which suppliers can protect their rights to suspend supply or encourage payment through tactics like charging late payment interest or even termination of contracts after repeated late payments or breaches of agreed terms.

2. With New Clients: Increasing visibility into your customer’s payment behaviour

In case of late payments, prevention is better than cure. Before onboarding a new customer, manufacturers, and suppliers should carry out thorough due diligence into the payment history, typical Days Beyond Terms (DBT), and financial performance of the customer. This is particularly important when a customer requests extended payment terms and credit facilities in the contract.

Due diligence is one of the most definitive ways to prevent cashflow-related problems in manufacturing firms. However, when under pressure, most small-to-medium-sized manufacturers skim through the process to avoid delays in client onboarding or because they lack the resources to devote to due diligence.

Employing the right technology, such as Creditsafe’s Accelerator platform, allows manufacturers to streamline a host of credit risk management measures from monitoring, credit checking, and compliance screening their customers across the world. Risk management platforms like the Accelerator can reduce credit and risk-based decision-making time by up to 70%. It brings trusted global business data, live insights, timely alerts, enterprise solutions, and automation together in one place, empowering a supplier or manufacturer’s global operations through a single, holistic risk management platform.

The new post-pandemic world is rife with unfair trade practices and payment policies that only benefit the market monopolists. In these times, Manufacturers need to increase their level of transparency and due diligence to not only prevent faulty partnerships with new customers but also level the playing field for every small-to-medium supplier, who can save themselves a lot of costly troubles when working with large retailers.