At the beginning of each month, the media eagerly picks up on the latest bankruptcy figures. This is logical, because together with the number of starting entrepreneurs, it is an important indicator for our economy and our society. But what exactly is such a bankruptcy? What procedure do companies that go bankrupt go through? What are the causes of the high number of failures? And what are the expectations for the future? What numbers are we talking about? You can read more about it on this page. Because understanding a problem properly is part of the solution.

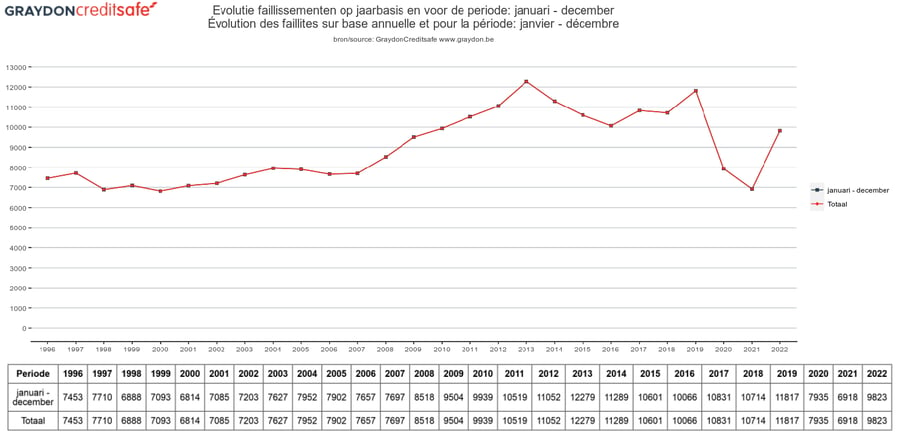

Overview of bankruptcies in Belgium over the past 25 years

Download the latest bankruptcy studies with all details below:

- detailed analyses and conclusions on the figures

- a comparison with the figures of other years

- the evolution on a geographical level

- the trends per sector

- the failure rate per legal form

- an overview of the number of bankruptcies by legal form and by age of the company

- the number of jobs lost (geographically and by sector)

-

November 2024

-

October 2024

-

September 2024

-

July-August 2024

-

June 2024

-

May 2024

Click the icon to download the study. The studies on bankruptcies were written in Dutch. Most of the graphs are in both national languages, Dutch and French. Older and other studies can be found in our (Dutch) press centre.

Definition: what is a bankruptcy exactly?

In short, bankruptcy is a legal procedure for the self-employed and companies that can no longer pay their bills. In purely legal terms, a company is said to be in a state of bankruptcy if the following two conditions are met:

- Payment suspension, which means that the organisation is struggling with a structural problem. It is therefore not a one-off default, but an accumulation of defaults.

- Shocked confidence, which mainly refers to the finding that the company cannot obtain credit or loans.

During the procedure, all the assets are sold in order to repay creditors.

How does the bankruptcy procedure work?

The bankruptcy procedure is as follows:

- Filing for bankruptcy with the Commercial Court. This application can be submitted by the creditors as well as by the debtor himself.

- Appointment of a receiver. The appointment of a curator is done by the court. The trustee draws up an inventory of all movable and immovable property and of the debts. All assets liable to be seized will be sold to repay creditors.

- Closing order by the judge. This legally concludes the bankruptcy. The debts that remain outstanding after this judgment are referred to as these 'residual debts of a bankruptcy'.

Since 1 April 2017, the procedure has been completely digital via the Central Solvency Register (Regsol), where those involved can view the bankruptcy file.

The Bankruptcy Act of 1997

In 1997, the legislator took a clear position: a bankruptcy only applied to companies in a 'hopeless situation'. If a company had reasonable chances of survival, it should be protected by the Business Continuity Act, today the judicial reorganisation procedure. In this way, the legislator tried to make bankruptcy an exception.

However, it soon turned out to be a utopia. The number of bankruptcies in Belgium continued to increase year after year and the WCO mainly aroused the resentment of creditors. Inadequate communication regarding unpaid invoices, while there was an obligation to deliver. The creditors were logically not happy about it.

The insolvency law reform in 2018

With the insolvency law that came into effect in May 2018, then Minister of Justice Koen Geens opted for a radically different approach to bankruptcies. Among other things, he ensured that the legislation was more in line with economic reality. A more modern and broader concept of entrepreneurship meant, for example, that liberal professions, agricultural entities, (certain) non-profit organisations and all natural persons with a self-employed professional activity could also go bankrupt. In addition, the new law focused much more on prevention and made every effort to give the bankrupt a second chance. And so, we are still trying to get rid of that negative connotation associated with bankruptcy.

The causes of bankruptcies

There are many reasons that can lead to bankruptcy. Periods of crisis or economic contraction never leave the business landscape untouched. Turnover declines, rising costs, collapsed margins, disrupted supply chains, lockdowns, but also mismanagement and wrong choices ... These are just a few factors that result in an increase in the number of companies that are (forced) to stop their activities.

Very recently, the Covid-19 dealt some serious blows. Thanks to the bankruptcy moratorium, all kinds of temporary support measures and by using private capital, many entrepreneurs were able to keep their heads above water for a long time. Since September 2022, however, we have again seen a clear increase in the number of bankruptcies.

Unfortunately, the end is not in sight yet, and we expect a further increase in the number of rulings in the course of 2023.

- Of companies that were unhealthy before the pandemic period, but that were granted a stay of execution due to the covid-19 measures.

- From companies that were healthy before the pandemic period, but that have run out of reserves due to the pandemic and that now must put up with it.

And then later the effects of rising energy prices and wage indexation should also follow in the bankruptcy figures.

Bankruptcy protection for your business relations

If you do business with other companies, you naturally want to limit the risk of non-payment as much as possible. How? By predicting when a company will get into trouble. Is that difficult? Not really, as there is plenty of information available to fall back on. Incidentally, companies that are heading for bankruptcy follow a fairly similar pattern. Years before, they often show the first defects or flashing lights, although not every flashing light has the same alarm value. Purely financial flashing lights based on the annual accounts score the weakest. For example, deficiencies in social obligations, managers who have been reported in other companies or missing publications carry more weight.

A credit report gives you a clear and detailed picture of any flashing lights and their impact on the financial health of your customer or supplier. By consistently and preventively integrating this into your (automatic) acceptance procedures, you protect yourself optimally against the bankruptcy of a customer or supplier.

A change of mentality around bankruptcies

In the 1980s, especially under Anglo-Saxon influence, there was a change in mentality regarding bankruptcies. Especially on a humane level. While the bankrupt used to be pilloried and even imprisoned for not fulfilling his obligations, the bankruptcy law spoke of the 'unfortunate bankrupt natural person'. Bankruptcy was increasingly seen as the result of unfortunate circumstances.

More and more often it was the creditor – the shark that inexorably wants his money – who ended up in the eye of the storm. As a result, the creditor, who often desperately needs the payment of his claim, lost his rights, and no longer enjoyed protection. On the contrary, the protection of the bankrupt ensured that the creditor was left with frustrations and headaches.

In Europe, meanwhile, many efforts are being made to give unfortunate bankrupts every chance to start over. This is the so-called second chance principle - unless there is evidence of fraud. In addition, bodies have been set up, such as the Chamber for Enterprises in Difficulty, which preventively look for companies that threaten to go off the rails and then adjust them accordingly. This preventive approach must ensure the continuity of these companies, so that the rights of creditors are also safeguarded.